Almost 65,000 zero-emission trucks and tractor-trailers were sold in China in the first half of 2024, ICCT says

Slightly less than 65,000 zero-emission trucks were sold in the first half of the year. It's more or less the same number of new energy vehicles sold throughout the whole 2022. Battery electric trucks have 9% market share in the heavy-duty segment, and 10% market share in the medium-duty segment. Also, in the first half of 2024, sales of swap-capable vehicles increased and reached a total of 2,497 in June 2024. That is up 87% from the first half of 2023.

The International Council on Clean Transportation (ICCT) released another extremely interesting report on zero-emission (or new energy) industrial vehicle sales in China. It’s quite interesting to notice that slightly less than 65,000 zero-emission trucks were sold in the first half of the year. It’s more or less the same number of new energy vehicles sold throughout the whole 2022. Also, Chinese fugures continue to be quite different compared to other valuable regions of the world, such as Europe (see here a similar report from ICCT) or North America. In addition, about 13,000 zero-emission buses were sold in the first half of this year.

The heavy truck market in China in 2024

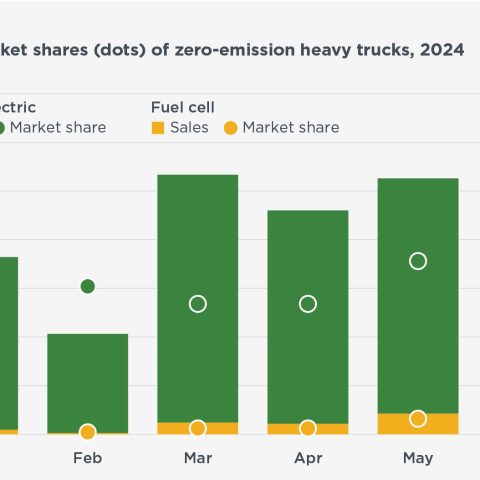

The whole report is available here, by the way. Talking about segments, the heavy truck market saw changes in the mix of fuel types from previous years. In the first half of 2024, diesel trucks accounted for 55% of sales, down from 80% in the first half of 2023, and natural gas-powered trucks made up 35% of sales, up 8% year-on-year. Battery electric trucks reached a 9% sales share and were the third most popular powertrain technology in the market. In June, the market share of battery electric heavy trucks hit a new high of 14%, a 35% increase from January 2024. The market for fuel-cell heavy trucks remains nascent, with 332 vehicles sold in June 2024, a 1% market share.

When it comes to medium-duty trucks, diesel remained the dominant powertrain in the medium truck market in the first half of 2024, accounting for 86% of total sales, a 4% year-on-year decrease. Battery electric reached a 10% market share, making it the second most popular powertrain in the segment. As in the heavy truck market, LFP is the dominant battery chemistry among medium trucks in China. Most electric medium truck models were equipped with 100 kWh batteries to balance cost and available range.

Battery swapping is gaining momentum

Finally, the ICCT focused its attention on the matter of battery swapping. Here, the Chinese market is achieving great results. In fact, in the first half of 2024, sales of swap-capable vehicles increased and reached a total of 2,497 in June 2024. That is up 87% from the first half of 2023. The popularity of swap-capable vehicles has been jointly driven by policy and market developments. Several policies were introduced in 2024 to support this emerging technology, and pilot projects have been launched to assess use cases in several industries, including mining, steel, and port logistics.