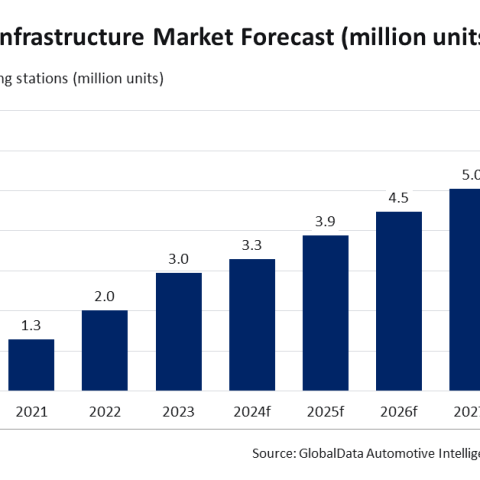

[GlobalData] APAC EV infrastructure market to expand at 13.5% CAGR over 2024-29

GlobalData’s latest report reveals that the automotive EV infrastructure market covering two types of charging stations, fast charging stations powered by direct current and slow charging stations powered by alternating current, is estimated at 3.3 million units in 2024 and is forecast to reach 6.2 million units by 2029 in the APAC region.

Governments worldwide currently face the challenge of creating the strong infrastructure required to accelerate the shift toward electric vehicles (EVs). The Asia-Pacific (APAC) region is experiencing significant growth in this area, with China leading as a major EV market and boasting an extensive infrastructure. Government agencies and private entities in other nations in the region, such as South Korea, India, Japan, and Indonesia, are also actively participating and investing in the expansion of charging station networks. Against this backdrop, the APAC EV infrastructure market is expected to record a compound annual growth rate (CAGR) of 13.5% over 2024–29, according to GlobalData, a leading data and analytics company.

GlobalData’s latest report, “Global Sector Overview & Forecast: EV Infrastructure Q3 2024,” reveals that the automotive EV infrastructure market covering two types of charging stations, fast charging stations powered by direct current and slow charging stations powered by alternating current, is estimated at 3.3 million units in 2024 and is forecast to reach 6.2 million units by 2029 in the APAC region.

Madhuchhanda Palit, Automotive Analyst at GlobalData, comments: “To facilitate the widespread adoption of EVs in the APAC region, it is critical to enhance the EV charging infrastructure. Considering that APAC is the most densely populated region in the world, the prospect of long wait times at charging stations may deter potential EV consumers. Therefore, to achieve the electrification goals set by the governments of APAC countries and to drive EV adoption, there is an urgent need to augment the quantity of EV charging stations, with a particular focus on fast charging stations.”

Several initiatives are underway to address the need to expand EV infrastructure. For instance, Volt, an EV charging company within the infrastructure division of Singapore-based Keppel, announced in July 2024, the deployment of a new fast-charging hub in the country. This hub features ratings of 360 kilowatts and 120 kilowatts, enabling electric cars to be charged in as little as 10 minutes.

Palitadds: “The expansion of fast-charging stations for EVs is essential, but there is also a pressing need to ensure equitable distribution across the nation. This distribution challenge has impeded EV adoption, even in countries like China, which is the world’s largest EV market. In China, the concentration of EV charging infrastructure in urban areas far exceeds that in rural areas. This disparity may discourage potential EV customers in rural areas and those planning longer journeys.”

Additionally, the overabundance of chargers in urban areas can lead to underutilization, while those along highways and in rural areas may not meet peak demand during holidays, resulting in potential profit loss and job cuts for EV charging businesses in both urban and rural settings.

A significant percentage of EV charging stations still rely on electrical power produced using fossil fuels, which can limit the environmental benefits of EVs. However, the landscape has changed significantly in recent years, with multiple initiatives by both the public and private sectors to transition the power source to renewable energy. For example, in India, The Climate Pledge, co-founded by Amazon and Global Optimism, announced in September 2024, an investment of $2.7 million in a new project, the Joint Operation Unifying Last-mile Electrification (JOULE), to build a network of shared EV charging stations powered by renewable energy in Bengaluru.

Recognizing the concerns and needs for growth in the sector, multiple innovations are being introduced at various stages of implementation. For instance, crowdsourced EV charging, V2G power management, and bidirectional charging are some of the innovations in the early stages of development with steadily rising adoption rates. Meanwhile, EV inductive charging and dual-voltage charging stations are examples of innovations in the maturing stage, which have become well-established within the industry.

Palit concludes: “Establishing adequate infrastructure is a time-sensitive matter, and the pace of progress varies among different nations. The increasing demand for EVs, coupled with substantial investments and research and development efforts, is expected to drive significant growth in the EV infrastructure sector in the near future.”

Read also: [Global Data] Electric vehicles discussions in APAC region up by 28% in 2022