[GlobalData] APAC petrol engines market to decline at negative 5.8% CAGR over 2024-29

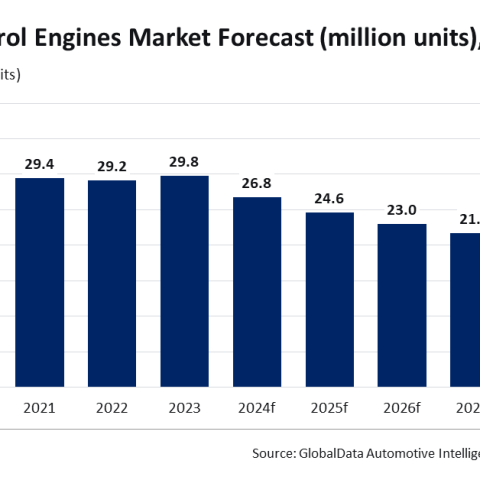

The petrol engines market is expected to record a negative compound annual growth rate (CAGR) of 5.8% in the Asia-Pacific (APAC) region over 2024-29, according to GlobalData, a leading data and analytics company.

Asian countries have demonstrated a proactive approach in implementing policies that foster the growth of the electric vehicle (EV) market, aimed at environmental sustainability and enhanced competitiveness in the global automotive manufacturing and export sectors. This strategy is contributing to a declining demand for traditional internal combustion engines (ICEs), especially in the passenger car segment. Against this backdrop, the petrol engines market is expected to record a negative compound annual growth rate (CAGR) of 5.8% in the Asia-Pacific (APAC) region over 2024-29, according to GlobalData, a leading data and analytics company.

GlobalData’s latest report, “Global Sector Overview & Forecast: Engines Q3 2024” reveals that the petrol engines market is estimated at 26.8 million units in 2024 and is forecast to decrease to 19.9 million units by 2029 in the APAC region.

Madhuchhanda Palit, Automotive Analyst at GlobalData, comments: “China has firmly established itself as a frontrunner in the global EV market. Other Asian countries are also making noteworthy advancements in the field of electrification. For instance, India implemented a program aimed at positioning the country as a viable manufacturing hub for advanced e-vehicles. This initiative includes a three-year timeline for the establishment of manufacturing facilities within India, with the goal of commencing commercial production of EVs. However, despite government initiatives to promote EVs, consumer reluctance to shift still exists due to several factors, including the high cost of EVs. In order to speed up the transition to EVs, capturing the economical vehicle segment can be a big push towards electrification, especially in a price-sensitive country such as India. Low priced launches such as Tata Nano EV model may act as a significant push towards electrification and further cause the downfall of the engine market in the passenger car segment.”

To comply with emission standards, manufacturers are implementing various initiatives. The demand for turbocharged and supercharged engines is increasing in countries with low adoption rates of EVs. These technologies utilize forced induction to enhance the efficiency of ICEs. Furthermore, advancements such as variable valve timing (VVT), sophisticated fuel injection systems like direct fuel injection, advanced aerodynamics such as active grille shutters, and exhaust after-treatment solutions, along with the incorporation of lightweight materials, are being employed to further enhance fuel efficiency and minimize emission levels.

Palit concludes: “In light of the numerous challenges associated with widespread electrification, which necessitates substantial investment and time, manufacturers are actively seeking solutions to comply with emission standards. In the meantime, adequate investment in research and development (R&D) on advanced engines and solutions for increased efficiency and sustainability is needed for the betterment of the petrol engine market. While it is anticipated that the market for ICE-powered vehicles may eventually face decline driven by transition towards full electrification in the APAC region, the timeline for this shift appears to be extending beyond initial expectations.”

Read also: APAC exhaust and ICE’ ATS according to GlobalData