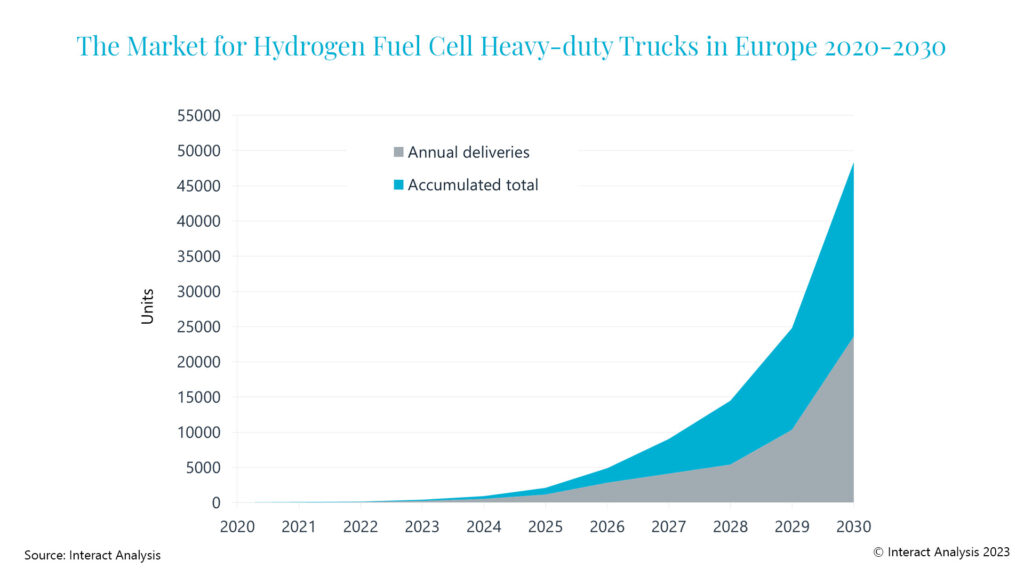

[Interact Analysis] 2030: over 45,000 hydrogen heavy trucks in Europe

By 2030, heavy duty trucks will dominate the hydrogen fuel cell market. While China will lead, Europe will also experience high penetration. In this new insight, Marco Wang, Research Analyst at Interact Analysis, discusses the long-term outlook for the global hydrogen fuel cell truck market.

According to newly published research by Interact Analysis, heavy-duty trucks will be the most common application of hydrogen in transportation in 2030. China will lead the market over the next decade, with Europe also seeing penetration rising fast. While the market for hydrogen heavy trucks is much smaller than in China, Europe is still well in advance of other regions. Our research estimates that an accumulated total of 45,000 heavy-duty hydrogen trucks will be deployed in Europe by 2030.

The advantages of decarbonizing heavy-duty vehicles, which can be hard to electrify, are what makes hydrogen a viable fuel in the commercial transport sector. However, high lifetime costs and limited hydrogen availability (particularly of green hydrogen) remain challenges. Emerging hydrogen solutions in the European heavy commercial vehicle market are reliant on government incentives; with city buses accounting for most of the hydrogen commercial vehicles in operation and the pace of growth for trucks slower.

Garbage trucks driving hydrogen deployments

Demonstrations of fuel cell technology in trucks have been carried out in Europe, starting with garbage trucks. According to Interact Analysis, around 25% of the hydrogen medium- and heavy-duty trucks running in Europe today are used for urban waste collection. EU-funded demonstration projects are driving deployments:

- The Revive project aims to integrate fuel cell powertrains into 15 refuse trucks and deploy them across 8 sites in Europe. The project will run until 2024 and is funded by the EU. Most of the vehicles deployed will operate for at least 5 years.

- The Hector project will deploy and test 7 garbage trucks powered by hydrogen fuel cells in 7 pilot cities. The EU has provided €5.6million in funding for the scheme, which started in 2019 and saw the first vehicle delivered to Germany in 2020.

In Germany, the government has supported the market activation of hydrogen and fuel cells by investing €354 million between 2017-2021, 30% of which was invested in projects to purchase 146 fuel cell refuse trucks and 22 road sweepers. Interestingly, many hydrogen trucks in China today are also used for road sweeping and garbage collection. The public sector seems more receptive to this emerging but costly technology, and this appears to be driven by municipalities, where budgetary concerns are balanced against positive publicity.

Hyundai’s successful European fuel cell truck rollout

Ahead of European OEMs, the first large commercial step in fuel cell heavy trucks in Europe has been taken by Hyundai. As the first phase of an ambitious plan in Switzerland, Hyundai delivered the first fuel cell truck for commercial use in Europe in 2020. By 2021, Hyundai’s activities lead to a delivery of about 50 trucks, the largest delivery of hydrogen trucks so far. The number is even larger than hydrogen trucks operated in Korea. As of end 2021, only 5 hydrogen trucks were delivered in Korea.

The scope of Hyundai’s hydrogen truck strategy in Europe is expanding. Germany will be the next market for Hyundai’s fuel cell truck fleet. These trucks will be operated by German logistics, manufacturing, and retail companies. At the end of 2022, the trucks for the first phase arrived at customers, with the project receiving funding from the German. Mitea GmbH will be the first client to operate the hydrogen trucks.

In addition to Hyundai’s trucks, a few fuel cell trucks supplied by local OEMs are being demonstrated for food and goods distribution in North- and West Europe (Hyundai’s trucks are also delivered to supermarket and logistics company to distribute consumer goods). It shows that the logistics service for retailers is another scenario where hydrogen heavy-duty trucks are being tested. The motivations behind these trials also show similarities – either the operators or the clients want a low carbon freight transport, or battery electric trucks cannot sufficiently meet the needs of the operation. For example, some hydrogen trucks are operated in high-altitude mountainous areas in Switzerland, with very low temperatures in winter. The performance of the hydrogen fuel cell system has been shown to not experience any degradation in these conditions, while the reduced performance of electric vehicles at low temperatures could be the biggest concern.

Infrastructure determines success, partnerships initiate scale rollout

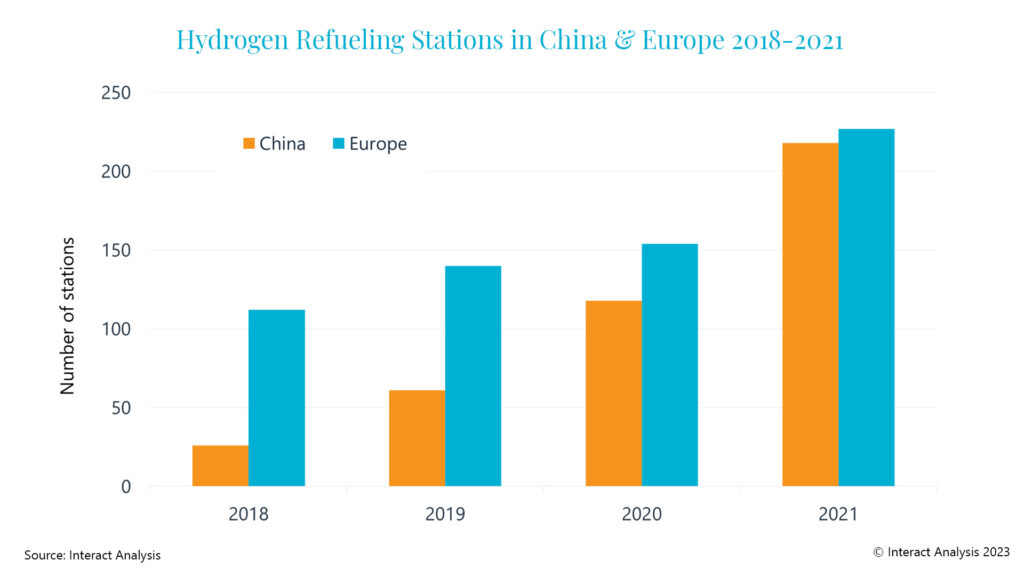

It is critical that hydrogen refueling stations are in place when the rollout of trucks is scaled up. Compared with city buses, the route of freight transport is less fixed and is determined by specific business requirements. It will be difficult for the fuel cell truck market to gain commercial momentum before refueling networks are widely available. The cost of hydrogen is another problem for vehicles with high fuel consumption. European governments are targeting low carbon hydrogen for its ecological benefits, but grey hydrogen is still the most affordable solution today.

The number of hydrogen stations in Europe was approximately the same as in China at the end of 2021, but almost half of these are in Germany. More importantly, many hydrogen stations in Europe cannot be used by heavy commercial vehicles, while in China almost all stations are designed for refueling trucks and buses. In recent years, China accelerated the pace of infrastructure building, through substantial investment. But the expansion of infrastructure is slower in Europe.

Multi-party cooperation is required for deployment in the market to gain scale. Deployment is not just about selling the vehicles. The refueling infrastructure, funding and affordable hydrogen also needs to be widely available. In fact, the launch projects that are underway in Europe are usually based on a broad partnership of the entire value chain – infrastructure, vehicles, operators and governments.

- Utilizing the EU’s €12 million funding, 15 suppliers partner in H2Haul projects aiming to demonstrate 16 heavy fuel cell trucks in Germany, Belgium, France and Switzerland.

- As part of the HyTrucks program, energy suppliers have joined the consortium partnering with government agencies, targeting 300 fuel cell trucks in Belgium by 2025.

- A consortium of 11 Austrian firms, H2 Mobility Austria, has set a target of 2,000 fuel cell trucks by 2030. Securing government support is its top priority in the near term.

- H2 Truck project sees 20+ partners across the entire value chain aiming to get 100+ fuel cell trucks and associated infrastructure in Norway.

H2 trucks are part of governments’ vision within the next decade

The EU considers hydrogen as a promising pathway for the transition to a carbon-free energy system. In the transport sector, many hydrogen strategies and roadmaps announced by the authorities of European countries target the use of fuel cell technology for zero-emission trucks.

- Netherlands: The National Climate Agreement specified an ambitious target for hydrogen, including 3,000 fuel cell heavy-duty vehicles by 2025.

- Germany: NRW, the most populous German state with the most hydrogen stations so far, has set a target of 11,000 fuel cell trucks of over 20 tonnes by 2030. Germany has created a systematic investment and action plan for hydrogen as part of its national strategy.

- Spain: A target of more than 5,000 fuel cell trucks by 2030 was proposed in the Spanish Hydrogen Roadmap.

- Czech: The Czech Republic’s Hydrogen Strategy features a forecast for future hydrogen consumption in transport, including 4,000 hydrogen trucks by 2030.

- Italy: 2% of heavy long-haul trucks will be powered by hydrogen fuel cell by 2030, according to the forecast included in the Italian National Hydrogen Strategy Preliminary Guidelines.

Although hydrogen trucks are still waiting on the starting line, the commitment of European authorities to low-carbon hydrogen supply, hydrogen infrastructure and heavy transport decarbonization creates a positive outlook for the industry. Planning by government agencies and corresponding financial support gives a credible guarantee to secure investment. Construction of hydrogen infrastructure is already underway – an increasing number of electrolyzer projects and international agreements for importing hydrogen will enhance the availability of low carbon hydrogen and lower the cost of fuel cell electric vehicles in the near future.