[Interact Analysis] 80% of hydrogen refueling stations are located in just five countries

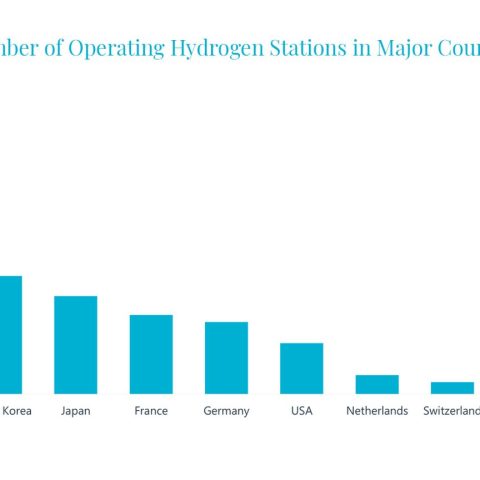

According to Interact Analysis, in 2024, 13 countries had more than 10 HRSs, accounting for 94% of the global total. Furthermore, China, South Korea, Japan, France and Germany had more than 100 operating stations each.

Interact Analysis recently launched its latest quarterly update for ‘Global Hydrogen Refueling Stations – 2024’. According to statistics, there were 1,369 hydrogen stations (HRS) deployed across 44 countries and regions worldwide by the end of 2024; with an additional 416 stations being planned or under construction. You can download the report here.

The HRS Network is expanding, but remains highly concentrated

In 2024, a growing number of countries commenced HRS construction – 8 countries and regions launched their very first hydrogen refueling station. However, global deployments of hydrogen stations remained highly concentrated. In 2024, 13 countries had more than 10 HRSs, accounting for 94% of the global total. Furthermore, China, South Korea, Japan, France and Germany had more than 100 operating stations each, accounting for a combined share of 79% of the global total.

Regionally speaking, Asia Pacific has the largest hydrogen refueling network, with 62% of the global total, or 849 stations, in operation by the end of 2024. China, South Korea and Japan were the world’s top 3 countries for operating HRSs, contributing 96% of the Asia-Pacific total. In addition, Australia had 15 hydrogen stations in operation, the majority of which are on-site stations with hydrogen production.

In the EMEA region, 27 countries had deployed 412 hydrogen refueling stations by the end of 2024. France overtook Germany to become the country with the largest number of HRSs in the region, accounting for 33% of the total HRSs in EMEA. Germany made up around 30% of the regional total.

In the Americas region, 108 operating hydrogen stations were located in 6 countries as of the end of 2024. The United States had 86 hydrogen stations in 12 states (including non-public stations), of which 73 HRSs were located in California. In addition, Canada commenced the construction of 10 hydrogen refueling stations in 2024, bringing its total operational stations to 18.

Over the past year, there are some noteworthy trends, which reflect the overall landscape of hydrogen in transport in different countries.

HRSs constructed at highway service areas in China: in 2024, several local governments in China started to implement free-toll policies for hydrogen vehicles, which will favor adoption of long-haul hydrogen fuel cell vehicles. Subsequently, six HRSs were opened in highway service areas in 2024, with more planned.

Increasing deployment of liquid hydrogen stations in South Korea: Incheon Gajwa LH2 HRS was inaugurated in April 2024, marking a new chapter in the deployment of liquid hydrogen refueling stations in South Korea. The country announced plans to build 280 LH2 stations by 2030. Furthermore, in 2024, only 5 of the 34 newly built stations in 2024 are exclusively for passenger vehicles, which is significantly fewer than in previous years. The majority of stations are for both commercial and passenger vehicles.

On-site hydrogen stations with electrolyzer installation in Australia: among the 15 HRSs in operation, 11 stations are on-site stations with hydrogen production, of which 10 are electrolysis-based and 1 is SMR-based (steam methane reforming based). This coincides with the country’s ambition to become a global leader in green hydrogen production. The Australian Government released its National Hydrogen Strategy in 2019 and updated it in 2024, with the new strategy focusing on accelerating clean hydrogen industry growth.

HRSs for diversified applications across regions: In 2024, more diverse applications of HRSs moved from planning to operation, especially those for railway use. China and Canada each commissioned 2 railway hydrogen refueling stations and India has also scheduled one station to be put into operation in 2024.