[Interact Analysis] China plans to build more than 1,200 hydrogen refueling stations by 2025

As a result of the boom in hydrogen fuel cell vehicle demand in China, demand for hydrogen refueling stations (HRS) has increased. Interact Analysis’ latest research by Shirly Zhu shows that 30 provinces and municipal cities across China have issued government policies and plans covering HRS development intentions. By 2025, China intends to have built more than 1,200 hydrogen refueling stations, more than the current worldwide number.

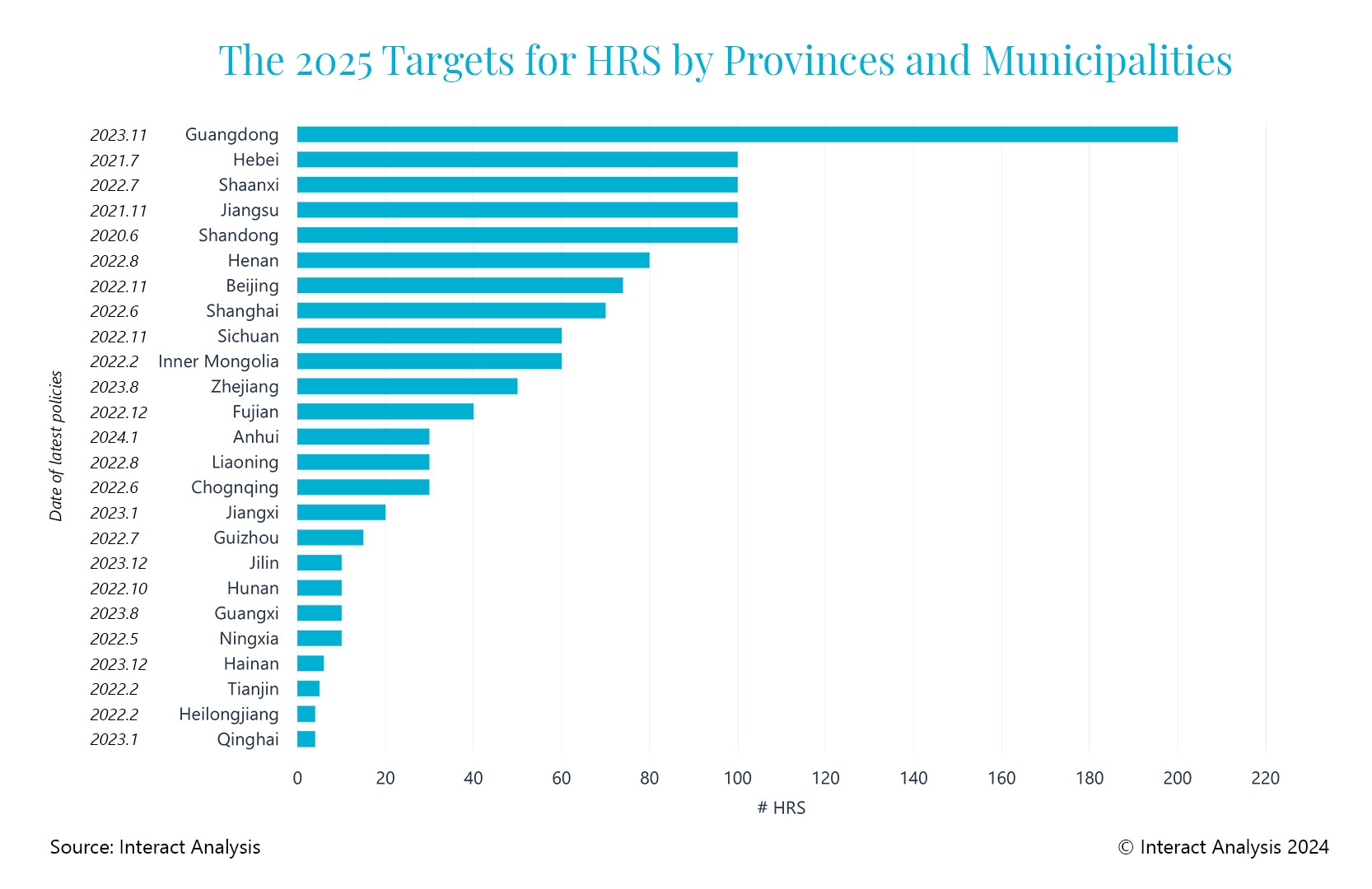

China’s boom in the promotion of hydrogen fuel cell vehicles is generating increasing demand for hydrogen refueling stations (HRS), which has resulted in them being included in government plans and regulations. According to Interact Analysis, 30 provinces and municipal cities across China issued government policies and plans covering the development of HRS. Of these, 29 local governments outlined 2025 targets for the construction of HRS, totaling more than 1,200 sites, which is more than the current global total.

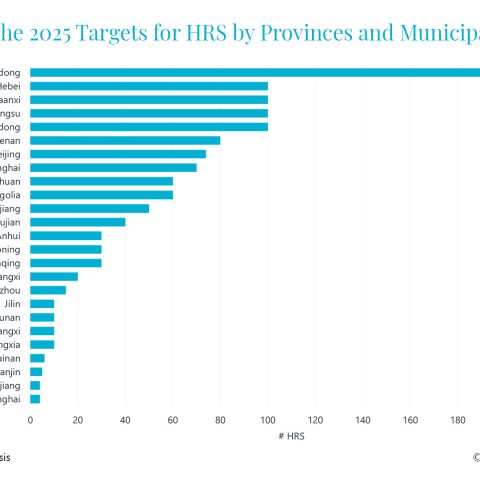

Pilot city clusters lead the way for construction of hydrogen refueling stations

According to our statistics, five provinces and municipal cities plan to build 100 or more HRS by 2025, with Guangdong aiming to reach 200 units. Our research found that pilot cities for hydrogen industry development announced higher targets for HRS construction to create an infrastructure for the adoption of fuel cell vehicles. For example, Hebei plans to build 100 HRS, while Shanghai, Beijing, and Henan have set targets for nearly 100 HRS sites. It is worth mentioning that Zhengzhou – capital of Henan province and leading promotion of fuel cell vehicles – plans to construct 110 HRS across the urban area in 2025, which is more than the construction target previously set by the whole of Henan Province.

Non-pilot provinces and municipal cities are also promoting construction of HRS to support increasing adoption of fuel cell vehicles. For example, Shandong plans to build 100 HRS by 2025, and Jilin and Guangxi province have also announced plans to accelerate HRS construction between 2025 and 2030.

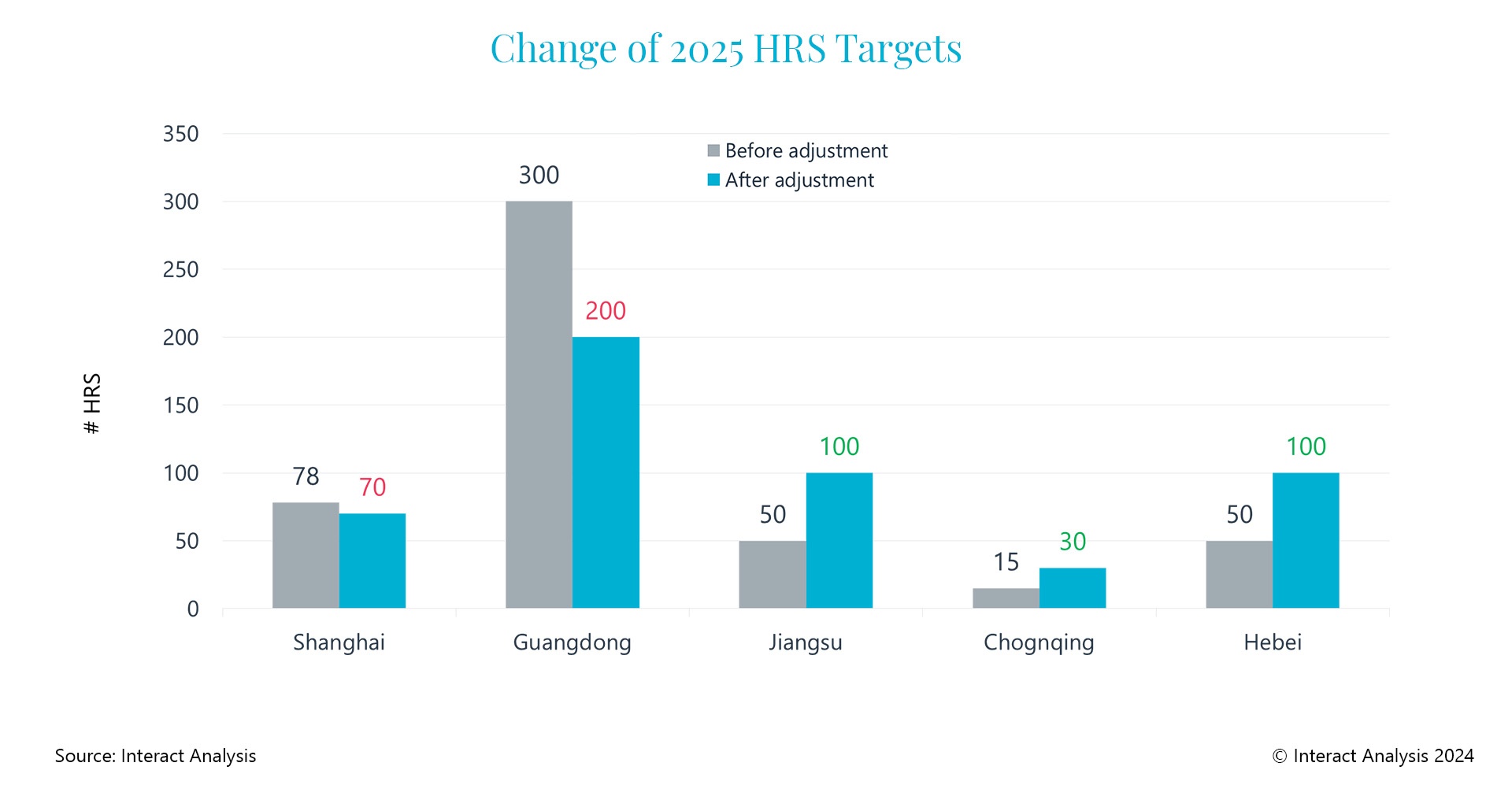

Hydrogen refueling station targets revised both upward and downward by local governmentsIt is very interesting to note that Chinese local governments adjusted their HRS targets during the past two years in line with deployments of fuel cell vehicles and regulations. The launch of the fuel cell vehicle pilot city clusters by Chinese central government can be seen as a catalyst for some regions adjusting their plans.

Jiangsu, Chongqing, and Hebei revised up their 2025 targets for HRS construction after the announcement from the central government. In November 2021, Jiangsu province announced its plan to build 100 HRS by 2025, increasing its target from the goal of 50 stations set in September 2019. Chongqing municipality also raised its 2025 target to 30 stations in June 2022, up from 15 planned HRS in March 2020. Furthermore, Hebei province increased its August 2019 target of 50 HRS stations by 2025 to a total of 100 stations in July 2021.

The Chinese central government rolled out the hydrogen fuel cell vehicle pilot city cluster initiative and later clarified hydrogen as part of its future national energy system and one of its strategic emerging industries. These moves provided substantial stimulus to local governments to promote development of the hydrogen industry. The adjustment of industry policies also reflected the increasing confidence of local governments in promoting hydrogen fuel cell vehicles.

However, in contrast Guangdong and Shanghai – both part of the pilot city clusters – revised down their 2025 targets for HRS construction. Guangdong declared in August 2022 that the province would build a total of 300 HRS stations by 2025, but the target was adjusted to more than 200 stations in the latest government document released in November 2023. Shanghai had planned to build a total 78 HRS by 2025 in a policy document published in February 2021, but in June 2022 Shanghai Development and Reform Commission adjusted the target to 70 stations. Local governments tended to be optimistic at the beginning of the rollout of pilot city clusters. With deployments of fuel cell vehicles and HRS construction progressing, targets have been adjusted to take into account the actual pace of implementation. In another word, the revision of planned targets reflects real-world deployments of fuel cell vehicles.

2030 targets set for hydrogen refueling station construction in some provinces and municipalities

In the context of developing the national hydrogen industry, some provinces and municipalities raised their medium- and long-term HRS construction targets to 2030 within their hydrogen energy plans and regulations. For example, Zhejiang province released a government document in August 2023 setting an objective to build a total of 89 stations by 2030 (alongside a 2025 target of 50 stations). Sichuan province announced its plans in November 2022 to construct a total of 80 HRS by 2030 (with a 2025 target of 60 stations). In addition, both Jilin and Guangxi provinces propose constructing 10 HRS each by 2025, while the 2030 targets are set at 70 and 50 stations respectively. The medium- and long-term targets reveal (to a certain extent), the confidence and determination of these provinces to develop the hydrogen industry in the long term.

Forming the infrastructure for fuel cell vehicles, the readiness of hydrogen refueling stations plays a significant role in the rollout of fuel cell vehicles, and government policies and plans are promoting the construction of HRS. As the 2025 hydrogen fuel cell vehicle pilot city cluster programme enters its latter stage, the relevant policies could usher in a wave of updates and changes to targets that will affect the development of hydrogen energy during the next five years. We will continue to pay close attention and provide updates as the market changes.