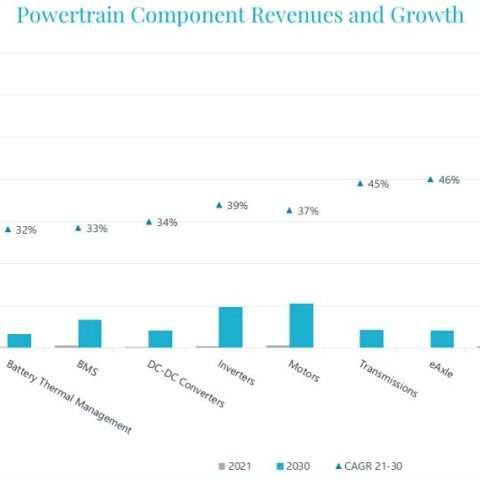

Interact Analysis: Electrified truck and bus powertrain components market in APAC worth $68 billion by 2030

By 2030, total electrified powertrain component revenues for the truck and bus market in Asia Pacific (APAC), will hit $68 billion, according to new research from Shirly Zhu, Principal Analyst at Interact Analysis. This is up from $3.7 bn in 2021 – a CAGR of 38%.

New research from Interact Analysis shows that total electrified powertrain component revenues for the truck and bus market in Asia Pacific (APAC), will hit $68 billion in 2030, up from $3.7 billion in 2021 – a CAGR of 38%. This is to service a rapidly growing APAC electrified truck and bus market, which is set to increase 18-fold from 2021 to 2030, reaching 4 million units. Battery electric is by far the leading powertrain type in APAC, accounting for 97% of all new energy on-road bus and truck units in 2021, a position that will be maintained out to 2030. Additionally, although fuel cells currently have a much weaker market position (with 2,000 units sold in 2021), they are set to enjoy phenomenal growth out to 2030 reaching 322,000-unit shipments.

Driven by the large volume of vehicle production, China leads the way in APAC, accounting for the dominant share of 83%, or $3.1 billion powertrain component sales revenues in 2021. The country will sustain its leading position for powertrain revenue generation, expected to reach $42.3 billion in 2030. Rest of Asian countries, including Japan, India, South Korea and other countries, are expected to grow by 51% annually up to 2030, when revenues will total $26.1 billion.

Battery electric was the dominant powertrain type, generating an estimated $3.4 billion sales revenues in 2021, constituting 91% of the powertrain total. Despite limited sales revenues in 2021, fuel cell powertrains are predicted to generate the fastest growing powertrain revenues, with a CAGR of 64% over the forecast period, reaching $27.6 billion revenues, or 40% of the market total in 2030, with a value of $27.6 billion. This will be as a result of increasing fuel cell vehicle adoption (particularly for heavy-duty trucks and large-size buses). Also, component revenues per vehicle are much higher than for the powertrains of battery electric and hybrid.

Shirly Zhu, Principal Analyst at Interact Analysis, says: “For me, one of the big stories in the electrified truck and bus powertrain components market for APAC is that the powertrain pricing of a battery electric vehicle is set to decline from $16,800 to $11,900 by 2030. In contrast, fuel cell powertrains will cost $86,000 by 2030, and this high price will still represent a decrease of 47% since 2021. The significant price erosion for powertrain components is mainly attributed to increasing demand for new energy buses and trucks, component product development, as well as intensive market competition. Further, the downward powertrain pricing will favor to narrow the price gap of electrified and ICE vehicles, and thusly drive the electrification of buses and trucks.”