[Interact Analysis] Light commercials drive rapid EV growth in China

In this new insight, Yvonne Zhang, Research Associate at Interact Analysis, highlights how the registrations of new energy commercial vehicles in China reached 21,000 units, an increase of 82% compared to May 2022. New energy light duty commercial vehicles are leading the market in China with fuel cell commercial vehicles registering the fastest growth rate.

In this new insight, Yvonne Zhang, Research Associate at Interact Analysis, highlights how the registrations of new energy commercial vehicles in China reached 21,000 units, an increase of 82% compared to May 2022. New energy light duty commercial vehicles are leading the market in China with fuel cell commercial vehicles registering the fastest growth rate.

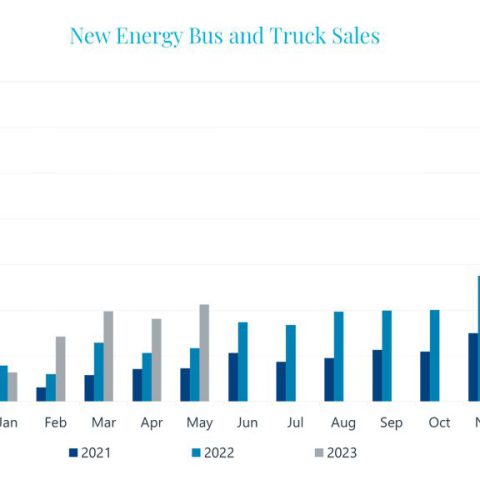

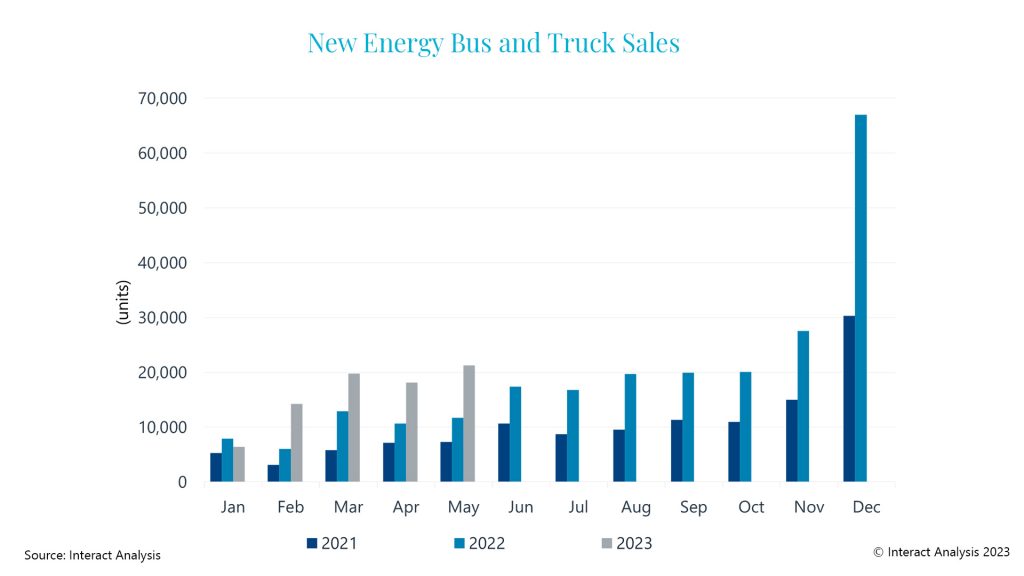

In May, total registration of new energy commercial vehicles in China reached 21,308 units, an increase of 82% compared with the same period last year and 17% higher than the previous month, reaching a new high for the year. According to Interact Analysis’ China New Energy Bus and Truck Market Tracker, this was the third highest monthly sales volume in recent years. The penetration rate of new energy commercial vehicles also continues to rise, reaching 8.9% in May from 5.3% for the same month last year.

New energy light-duty commercial vehicles led the market

In May, total sales of new energy light commercial vehicles exceeded 17,000 units, a year-on-year increase of 133%, accounting for 82% of overall sales of new energy commercial vehicles. Meanwhile, sales of new energy heavy-duty commercial vehicles reached over 2,537 units, down by 22% year-on-year. This decline was mainly attributable to a drop in sales of large buses (down 55% year-on-year), while the growth rate of new energy heavy-duty trucks also slowed down.

Fuel cell commercial vehicles had the fastest growth rate

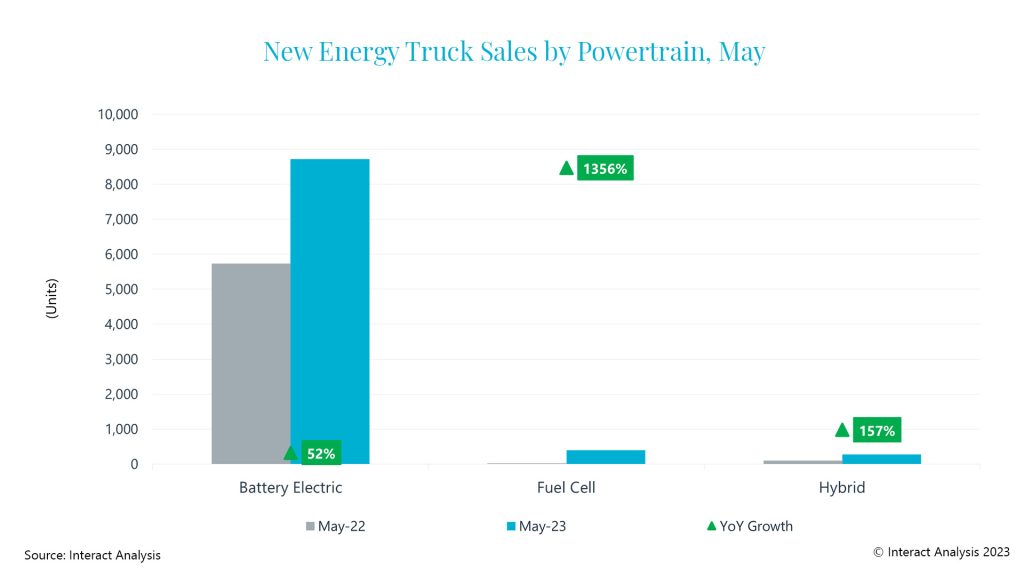

With various provinces and cities actively promoting development of the hydrogen energy industry, registration sales of fuel cell commercial vehicles reached 517 units in May, a year-on-year increase of over 8 times and a month-on-month increase of 19%, reaching a new high for the year. Battery electric vehicles have always been the backbone of China’s new energy commercial vehicle market, with sales of 20,518 units in May, an 81% year-on-year increase accounting for approximately 96% of the total. Sales of hybrid vehicles reached 273 units last month, falling by 10% year-on-year.

Medium and heavy-duty trucks new energy slowed down, while light-duty new energy trucks continued to gain momentum

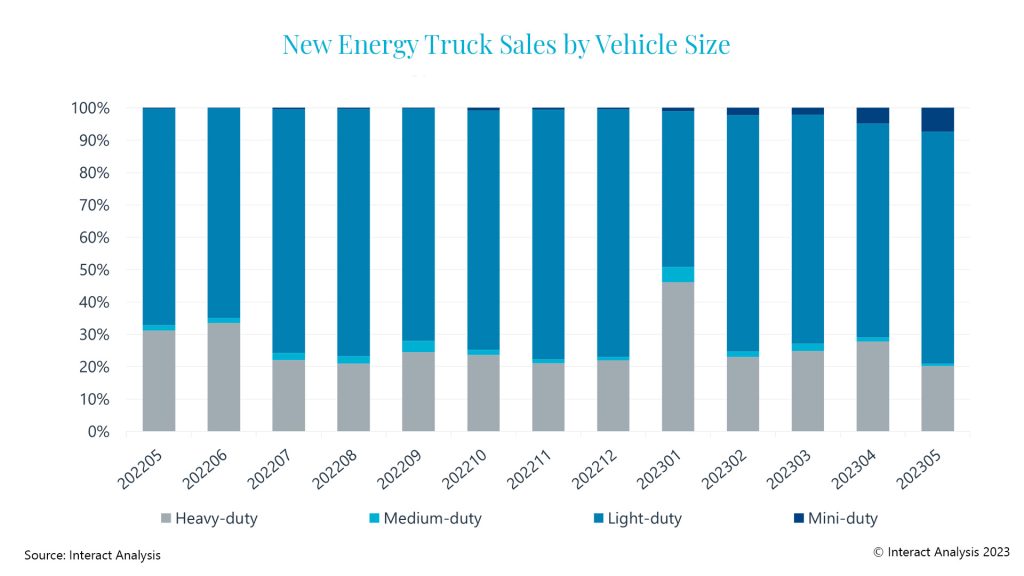

In May, registration sales of new energy trucks reached 9,392 units, up by 60% year-on-year and by 14% month-on-month, with the penetration rate rising to 4.5%. In terms of destination, new energy trucks were mainly sold to Guangdong, Hebei and Sichuan provinces, with Guangdong accounting for 18% of the total.

While sales of medium-sized trucks fell, the other three vehicle types all experienced year-on-year sales growth

Due to the small base in the same period last year, the new energy mini trucks segment showed the fastest year-on-year growth in May 2023, reaching 688 units primarily concentrated in the below 1.5-ton range.

Sales of new energy light-duty trucks reached 6,733 units over the month with a year-on-year growth rate of 72%, accounting for 72% of the new energy truck market and mainly consisting of battery electric logistics vehicles. Battery electric logistics vehicles have become more cost-effective than fuel-powered vehicles in specific scenarios such as urban transportation, stimulating the growth of battery electric light-duty and mini-duty trucks.

However, the growth rate in the medium and heavy-duty truck market has slowed down. Sales of new energy heavy-duty trucks increased slightly by 4% from last year to 1,899 units, accounting for 20% of the new energy truck market, with towing vehicles accounting for about 50%. In May, the majority of new energy heavy-duty trucks were sold to Hebei province, accounting for 26%, while the sales in other provinces accounted for less than 10%. Sales of medium-duty trucks reached 72 units, down by 32% year-on-year, marking the lowest monthly sales volume since March 2022.

Sales of all three new energy powertrains increased, with fuel cell vehicles growing fastestIn May, the terminal sales of fuel cell trucks increased by over 13 times from the same period last year, reaching 393 units and accounting for 76% of the overall fuel cell commercial vehicles. Heavy-duty trucks have been a dominant vehicle type for the promotion and implementation of fuel cell technology. In May, registration sales of fuel cell heavy-duty trucks reached 235 units, with a year-on-year increase of over 8 times. Sales of battery electric trucks reached 8,727 units, up by 52% year-on-year, with light-duty trucks accounting for 72% of the total. Sales of hybrid electric trucks increased by 157% to 272 units.

New energy buses – Stagnant large and medium-sized bus market, while small-sized buses drove market growth

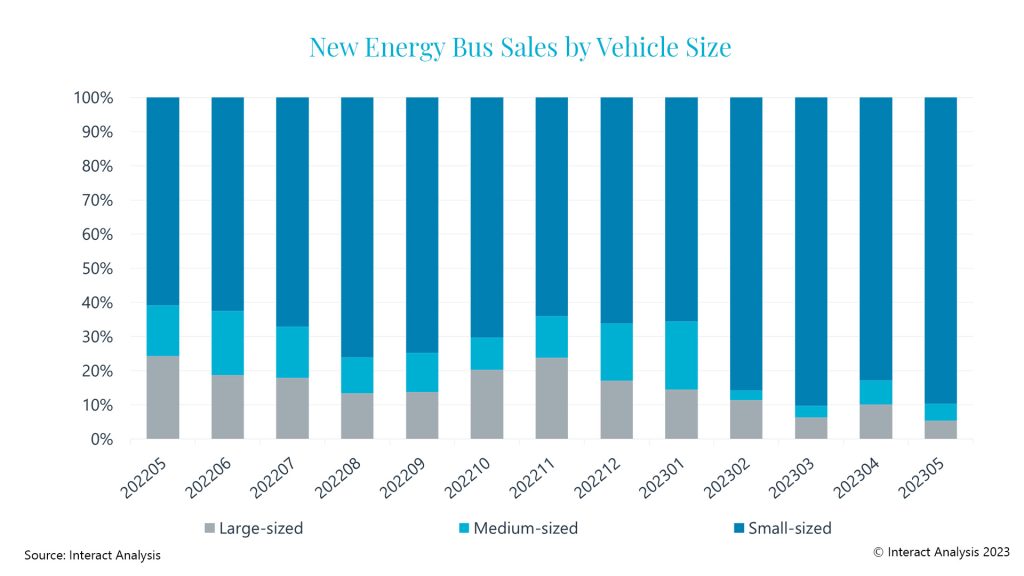

In May, sales of new energy buses reached nearly 12,000 units, marking a year-on-year increase of 105% and a month-on-month increase of 20%. The market penetration rate reached 38%, which is 11 percentage points higher than the same period last year and 4 percentage points higher than the previous month.

Small-sized buses drove the sales of new energy buses

Due to the cancellation of subsidies for new energy vehicle purchases, sales of large and medium-sized buses continued to decline in May, with year-on-year decreases of 55% and 32% respectively. Small-sized buses remained popular, with sales exceeding 10,000 units, up by 201% year-on-year, accounting for 90% of the new energy bus market, an increase of 29 percentage points compared with the same period last year.

Sales of battery electric and fuel cell powertrain buses have increased year-on-year

In May, the sales of pure electric buses exceeded 10,000 units, an increase of 111% compared with the previous year, accounting for 99% of total sales. A total of 124 fuel cell power vehicles were sold, up by 313% year-on-year, all of which were large- and medium-sized buses. Only 1 large-sized hybrid urban bus was sold in May this year.

Market Landscape – Concentration tends to increase

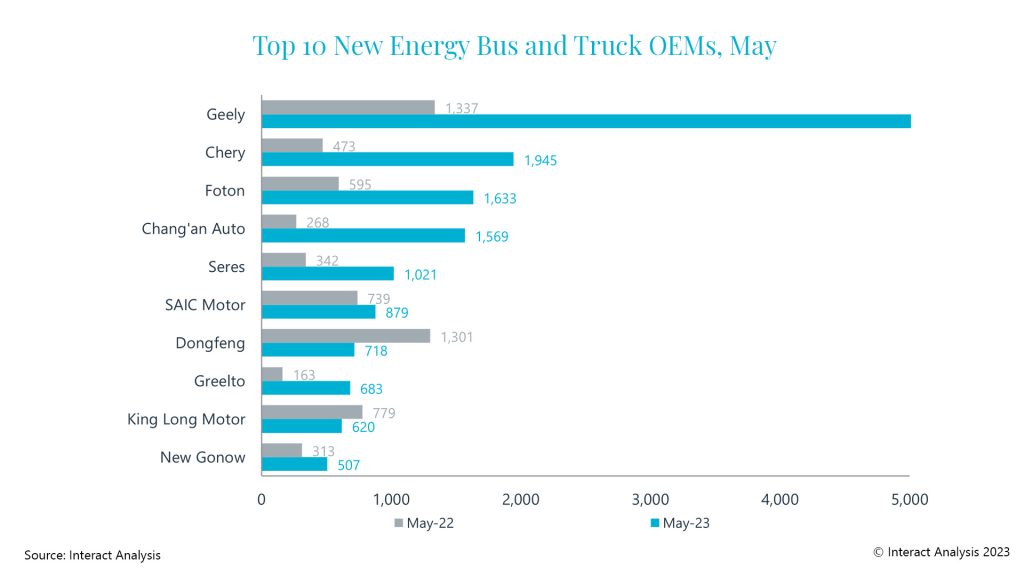

In May, over 90 OEMs had sales of new energy commercial vehicles, and the combined sales of the top 10 manufacturers accounted for 74% of the total, an increase of 11 ppts from the same period last year.

In May, the top three OEMs for new energy commercial vehicles remained unchanged from the previous month. Geely has been in first place for 13th consecutive months, with a market share of 29% in May. With the exception of King Long Motor, which focuses on large-sized buses, the sales of other top ten OEMs mainly focus on the sale of light-duty bus and trucks, with seven of them having a market share of over 90% in the light-duty vehicle segments. SAIC Motor, Greelto, and New Gonow re-entered the top ten list, while SANY, Zhengzhou Yutong, and JAC dropped out of the top ten rankings.