[Interact Analysis] More than 300,000 new energy commercial vehicles to be sold in China in 2023

According this new insight by Yvonne Zhang, Research Associate at Interact Analysis, during the first three quarters of 2023, registrations of new energy commercial vehicles in China have soared with the penetration rate reaching 9.2% – an increase of 3.2 percentage points year on year. Light duty trucks currently dominate the new energy truck market whilst this year has seen record sales of new energy small-sized buses.

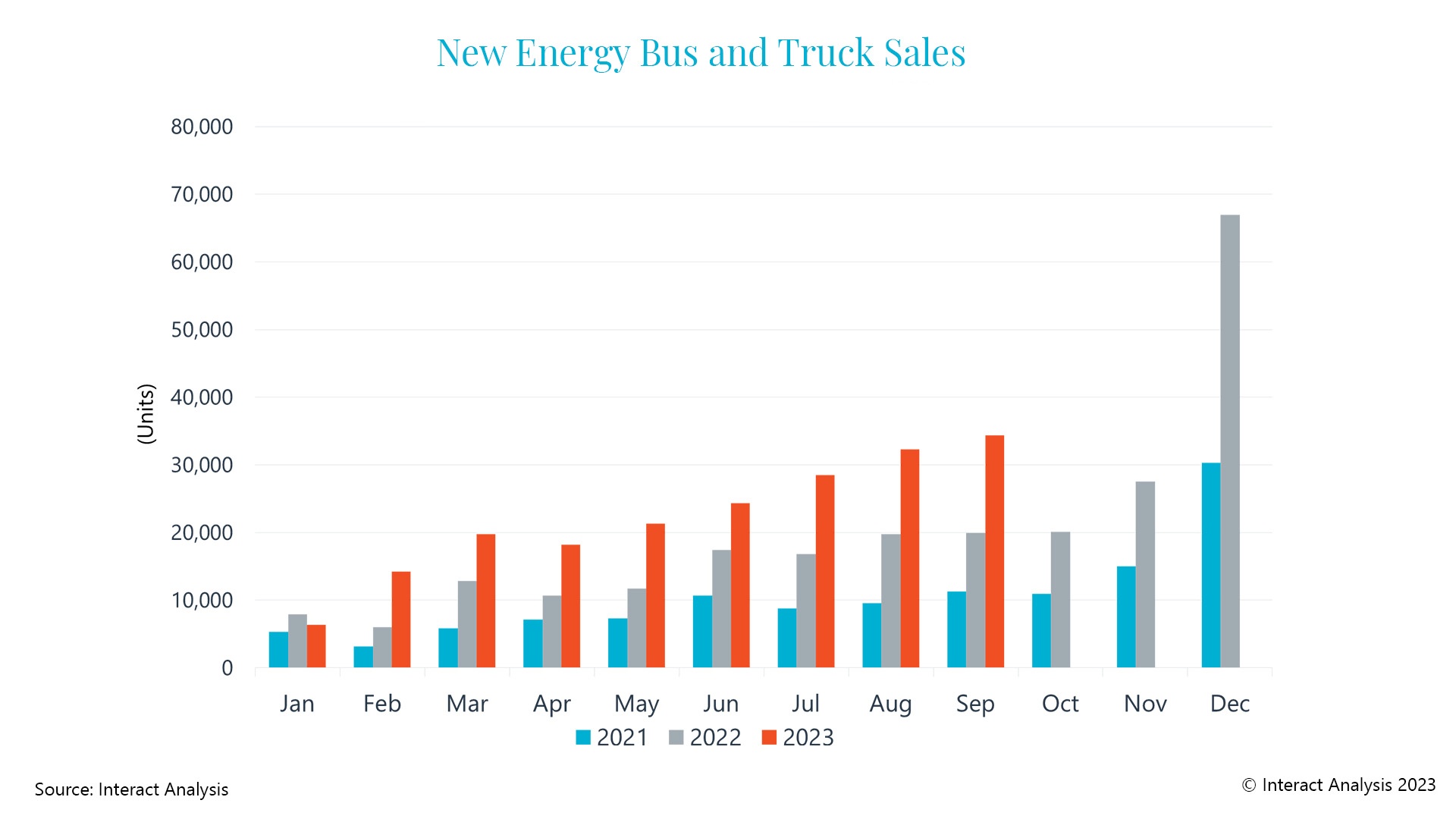

In the first three quarters of 2023, registration of new energy commercial vehicles (NECVs) in China reached 199,000 units, up by 62.0% year-on-year. Over the nine months to September 2023, sales of NECVs have already reached 83.9% of last year’s total (238,000 units in 2022). During the first three quarters of this year, the market penetration rate of new energy commercial vehicles increased by 3.2 percentage points year-on-year, reaching 9.2%, with rates for new energy trucks and buses standing at 4.8% and 38.4%, respectively.

In the first three quarters of 2023, registration of new energy buses reached 110,000 units, marking a year-on-year increase of 60.4%. This accounted for 55.1% of total new energy commercial vehicle sales and exceeded sales of new energy trucks for 16 consecutive months, which stood at more than 89,000 units during the same period.

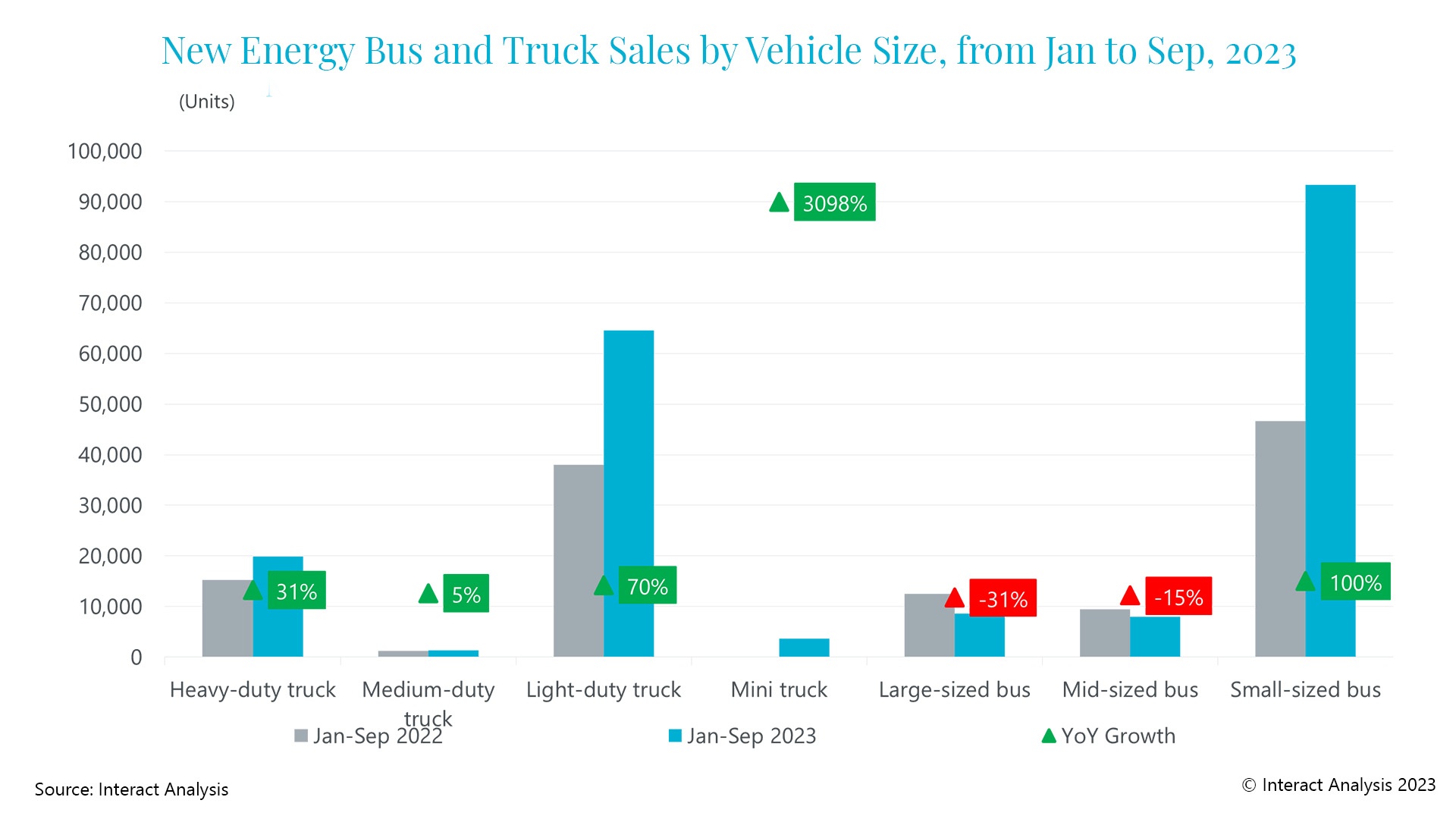

Light-duty trucks dominated the new energy truck market. As of September, registration of light-duty trucks reached 66,000 units, with a year-on-year increase of 69.9%, comprising a 72.2% share of the new energy truck market. This represented a 2.5-percentage-point increase compared with the same period last year and a 3.5-percentage-point increase over the first half of this year. Mini trucks, with a smaller sales base, have experienced substantial sales growth, up by 31 times to more than 3,600 units from January to September. In addition, sales of new energy heavy-duty trucks have been growing year-on-year for eight consecutive months. In the first three quarters of 2023, registrations of new energy heavy-duty trucks were up by 30.9% year-on-year to 20,000 units, with the majority of sales consisting of towing vehicles and concrete mixer trucks. New energy medium-duty trucks, primarily sanitation vehicles, registered sales of over 1,300 units, marking 5.3% year-on-year growth.

Record high sales for small-sized buses. In the first three quarters of this year, registration of new energy small-sized buses reached 93,000 units, doubling compared with the previous year, and accounting for 84.9% of the new energy bus market. In contrast, the markets for medium- and large-sized buses remained contraction, with registrations decreasing by 31.0% and 15.4% to 9,000 units and 8,000 units, respectively.

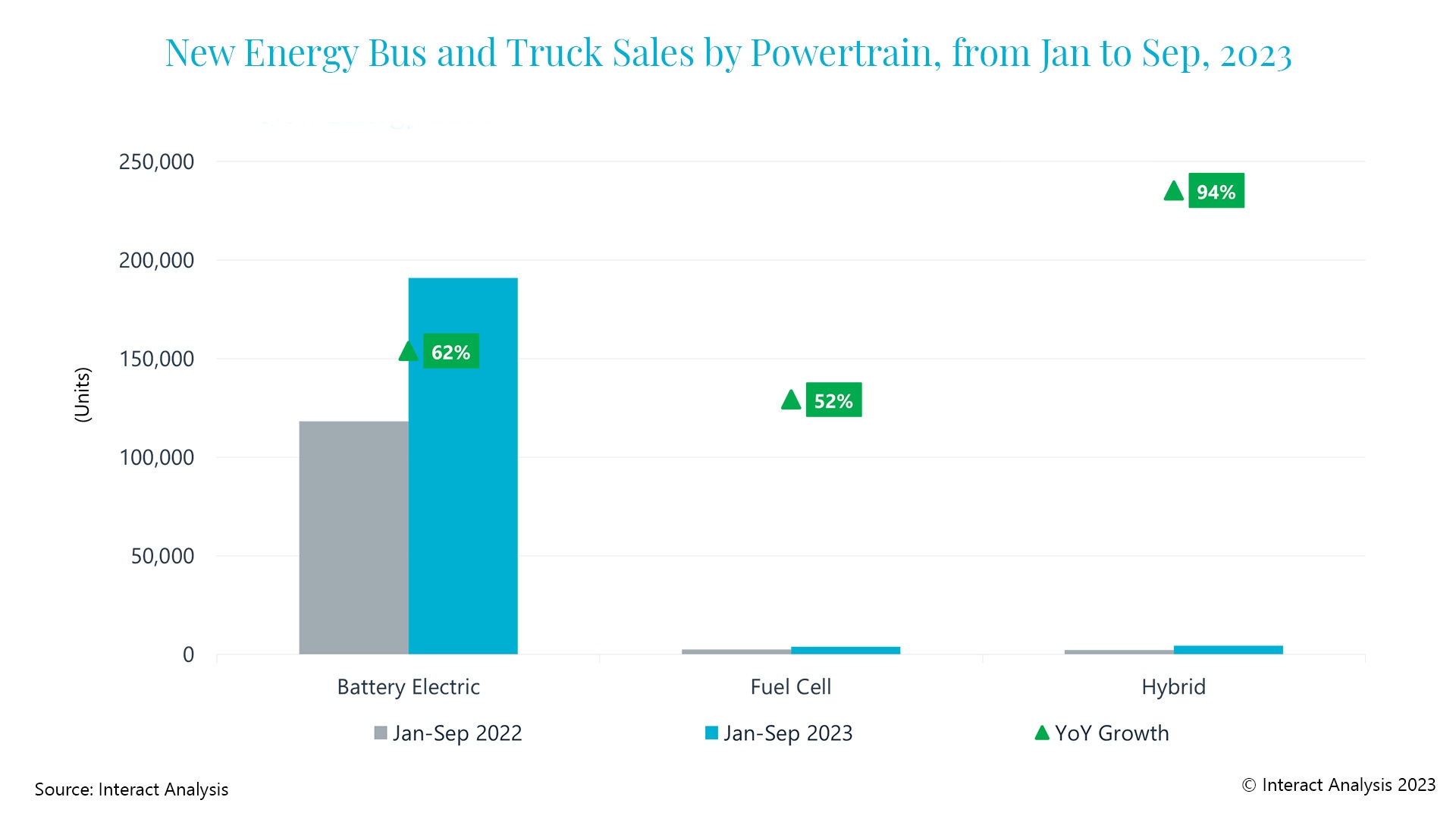

In the first three quarters of 2023, registration of battery electric commercial vehicles reached 191,000 units, marking a 61.6% year-on-year increase and accounting for a whopping 95.9% share of the new energy commercial vehicle market. Among these, battery electric trucks accumulated nearly 83,000 units in sales, demonstrating 60.2% year-on-year growth, primarily comprising battery electric light-duty logistics vehicles. Battery electric buses saw 108,000 units registered over the same period, reflecting a 62.6% year-on-year increase.

Registration of fuel cell commercial vehicles reached 3,798 units, representing a year-on-year increase of 51.7%. However, due to policy promotion falling short of expectations and advance purchases in the first half of the year, sales of fuel cell commercial vehicles have seen two consecutive months of decline. In September, 295 fuel cell commercial vehicles were sold, marking a year-on-year and month-on-month decline of 43.6% and 96.6%, respectively. Regarding vehicle types, registration of fuel cell trucks reached nearly 3,100 units during the first three quarters of this year, with an 81.7% year-on-year increase, primarily consisting of towing vehicles. Fuel cell buses accumulated sales of 700 units, experiencing a 12.4% year-on-year decrease, primarily comprising medium- and large-sized buses.

In the first nine months of 2023, sales of hybrid commercial vehicles totaled nearly 4,500 units, marking a substantial year-on-year increase of 94.1%. Among these, hybrid light-duty trucks particularly stood out. Hybrid vehicle models have been less affected by the withdrawal of new energy vehicle purchase subsidies, and, as applications of new energy light-duty trucks continue to expand, hybrid light-duty trucks are more viable in regions lacking charging infrastructure. As of September, registration of hybrid trucks reached 3,209 units, doubling compared with the same period last year. On the other hand, hybrid buses experienced weaker performance, with registration of 1,053 units, representing a 12.8% year-on-year decrease, primarily in the category of large urban buses.

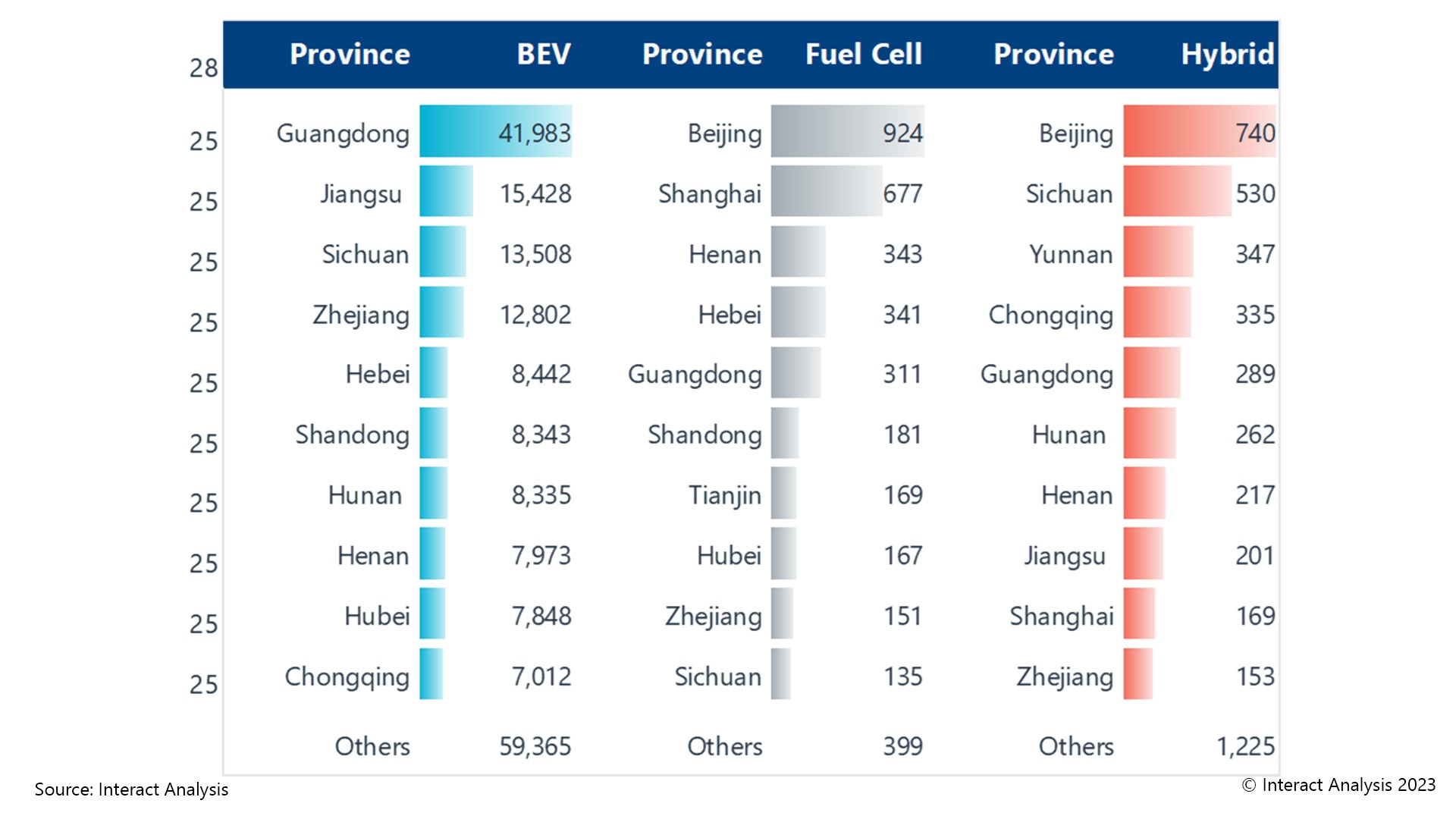

Widely dispersed regions for registration of new energy commercial vehicles

As of September, Guangdong, Jiangsu, Sichuan and Zhejiang provinces are the leading regions in terms of registration of new energy commercial vehicles, each with more than ten thousand units sold. Battery electric light commercial vehicles were the main vehicle type sold in these regions. Among the top ten provinces and municipalities for registration of battery electric vehicle models, Hebei was the only province in which heavy-duty trucks were the main vehicle type sold.

In contrast, fuel cell vehicles are mainly purchased in demonstration cities and regions such as Beijing, Shanghai and Henan. Of the top ten provinces in terms of vehicle registrations, Beijing, Guangdong and Hubei mainly saw registrations of fuel cell light-duty trucks, Zhejiang primarily recorded registration of fuel cell medium- and large-sized buses, while fuel cell heavy-duty trucks were the main vehicle type registered in other regions.

The sales destinations for hybrid commercial vehicles are more dispersed, with Beijing having the highest registration, mainly large-sized buses.

Geely leads the way, demonstrating a diversified growth pattern in the market

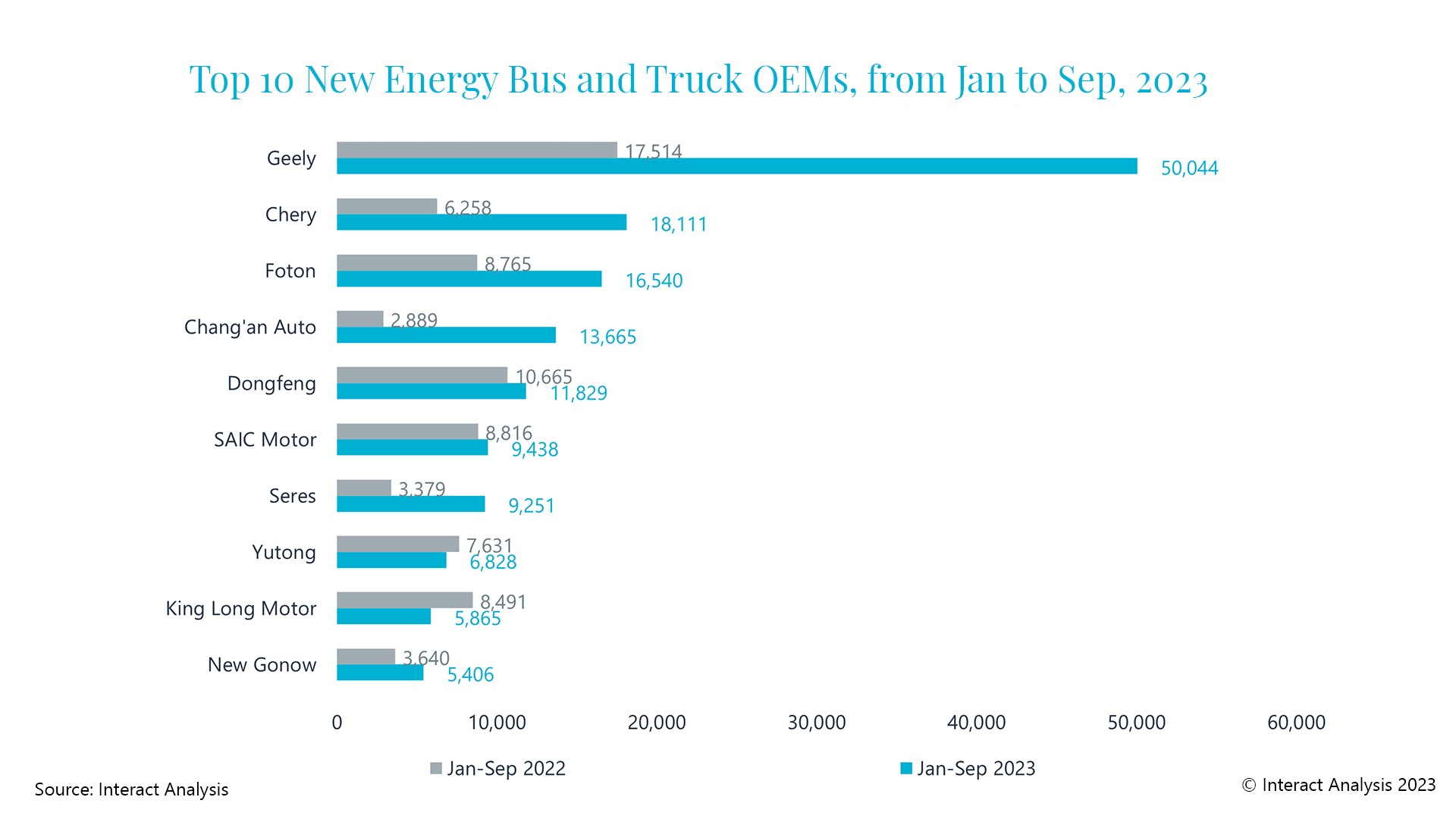

From January to September 2023, over 190 OEMs registered sales of new energy buses and trucks, with the top 10 OEMs accounting for around 73.7% of total units sold, up by 9.2 percentage points compared with last year.

Geely consistently held the top position, with registration in the first three quarters increasing by 185.7% year-on-year, already surpassing the previous year’s full-year sales. Chery ranked second, with registrations increasing by 189.4% compared with the same period last year and the company moving up five positions in the ranking. Among the top ten companies, Chang’an Auto experienced the fastest growth (with a growth rate of 3.7 times the same period of last year). Due to the downturn in the market for medium- and large-sized buses, Zhengzhou Yutong and King Long Motor witnessed a decline in sales, leading to a decrease in their rankings, while Guangxi Auto and Brilliance Shineray dropped out of the top ten altogether.

Among the top ten companies, Zhengzhou Yutong mainly sells heavy-duty and light-duty trucks, while King Long Motor primarily sells large- and small-sized buses. The rest of the companies primarily focus on light-duty commercial vehicles in their sales.