[Interact Analysis] Registration of new energy buses hit an all-time high in July

According to a recent research by Shirly Zhu, Principal Analyst at Interact Analysis, the Chinese truck and bus market is growing exponentially. In July 2022 alone new registrations totaled 16,793 units, a year-on-year increase of 92%.

According to our China New Energy Bus and Truck Monthly Tracker, the new energy bus and truck market maintained its highly impressive growth momentum in 2022, with new registrations totalling 16,793 units in July. This equates to a year-on-year increase of 92%.

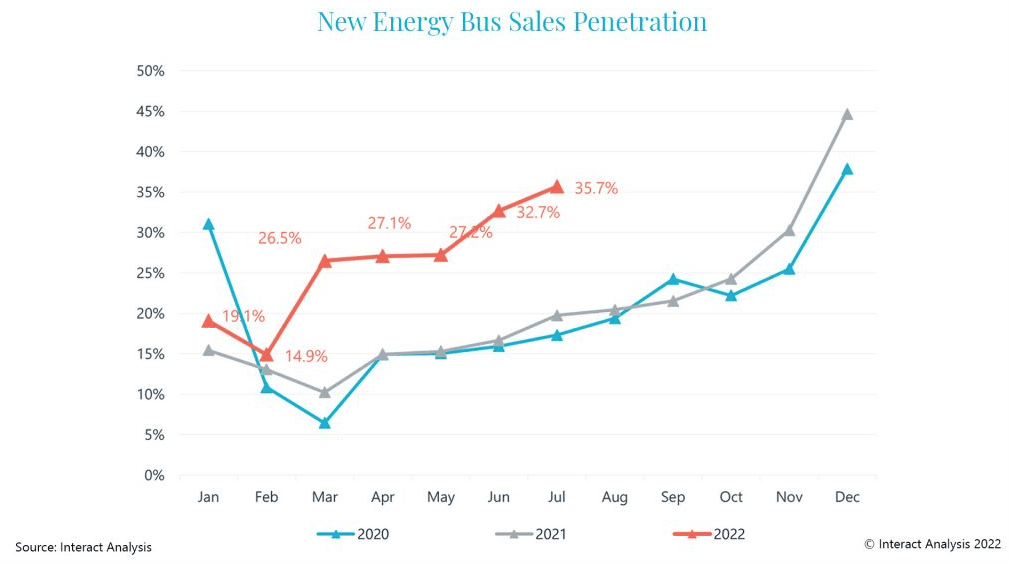

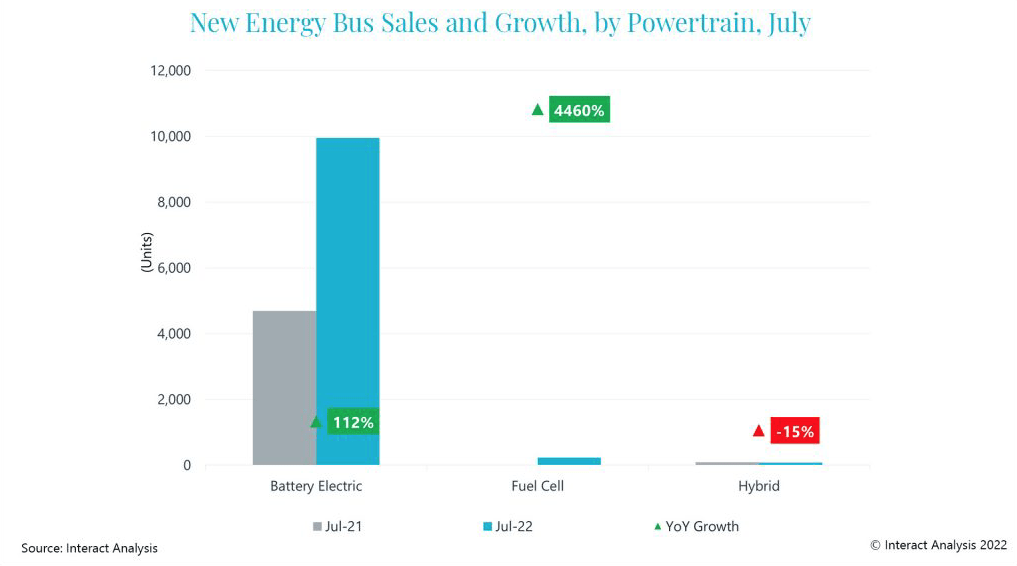

New energy bus sales increased by 114% to 10,247 units in July, hitting their highest ever monthly sales in 2022. This accounted for 61% of the total new energy bus and truck sales in the same month. Consequently, electric bus market penetration for July climbed up to 35.7% – also the highest rate in 2022.

Why such strong performance?

Delayed delivery of units during COVID

There are a few reasons for the extremely good performance of the market. The first being the delayed delivery of units during the COVID pandemic. As Shanghai manufacturers closed their doors once again as a result of a new outbreak of COVID, both demand and supply of electric vehicles was radically reduced. When the restrictions were lifted, the market experienced a surge in the number of trucks and buses delivered in June and July. Shanghai became the second largest sales destination for new energy buses in July, sitting just behind Guangdong province.

Small sized buses pave the way for growth

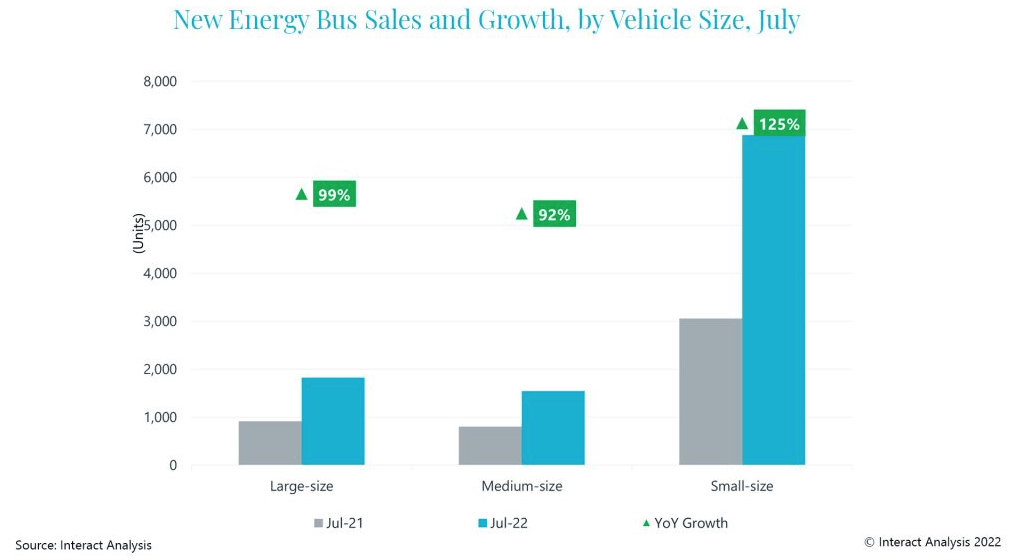

Secondly, small sized buses performed particularly well and as a consequence have driven the entire market. After many years of active promotion, the market for new energy large- and medium-sized buses has become saturated. City buses in tier 1 and tier 2 cities drove the growth trajectory for electrification for many years. Our new registrations data shows that small-size bus sales maintained the highest growth rate, with a 125% year-on-year increase to 6,878 units, or 67% of total bus registrations in July. Large-size buses on the other hand, realized the second positive year-on-year growth this year to 1,829 units, almost doubling their unit sales since July last year. Overall, small-sized vehicles dominate the market for electrification.

Promotion, promotion, promotion

Additionally, there has been a lot of effort put into promoting new energy vehicles despite the gradual withdrawal of financial subsidies from the central government in China. In particular, there are still many subsidy policies in place from local governments, and there is no sign that these will end any time soon. One important destination for such funding is hydrogen fuel cell vehicles, and fuel cell vehicle demonstrations are being rolled out in many provinces and municipalities. In July alone, registration of fuel cell bus and trucks skyrocketed to 584 units: representing growth of 395%, and causing 2022 to be a record high year in terms of sales of fuel cell commercial vehicles. Sales of fuel cell buses were responsible for 228 of these 584 units, meaning that fuel cell bus sales have increased by nearly 45 times year-on-year.

The supplier landscape

Finally, changes in the supplier landscape as well as in the dynamics of product structures and vehicle sizes have heavily influenced the increase in new energy vehicle sales. In July, Geely New Energy Commercial Vehicle was ranked the number one supplier, with nearly 2,000 unit sales. These were mainly attributed to its small-size buses. In contrast to this, major OEMs with a significant presence in the large- and medium-size bus segment experienced lower-than market average growth, meaning that they saw declines in their overall market rankings (even if, as companies, they may well still have grown compared to the previous year). For example, Xiamen King Long Motor and Yutong Group dropped to second and sixth positions in July – whereas in the equivalent period last year they had held the first and fourth positions.