[Interact Analysis] The dynamic market landscape of new energy commercial vehicles in China

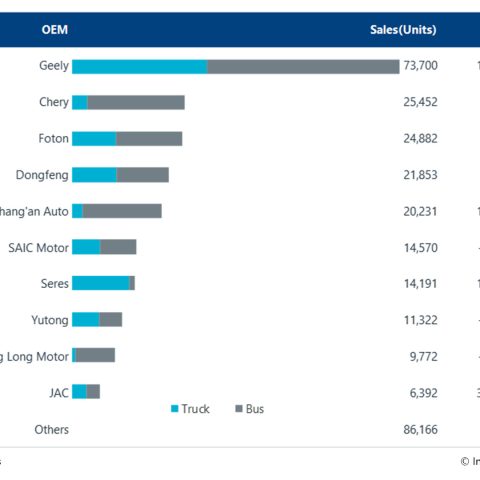

According to Interact Analysis’ latest update to its China New Energy Bus and Truck Market Tracker, in 2023 over 220 OEM’s sold new energy buses and trucks with the top 10 OEM’s accounting for around 72.1% of total units sold. Geely maintained its position as the market leader in China followed by Chery and Foton. Read the latest insight by Yvonne Zhang, Research Associate at Interact Analysis.

According to Interact Analysis’ latest update to its China New Energy Bus and Truck Market Tracker, in 2023 over 220 OEM’s sold new energy buses and trucks with the top 10 OEM’s accounting for around 72.1% of total units sold. Geely maintained its position as the market leader in China followed by Chery and Foton. Read the latest insight by Yvonne Zhang, Research Associate at Interact Analysis.

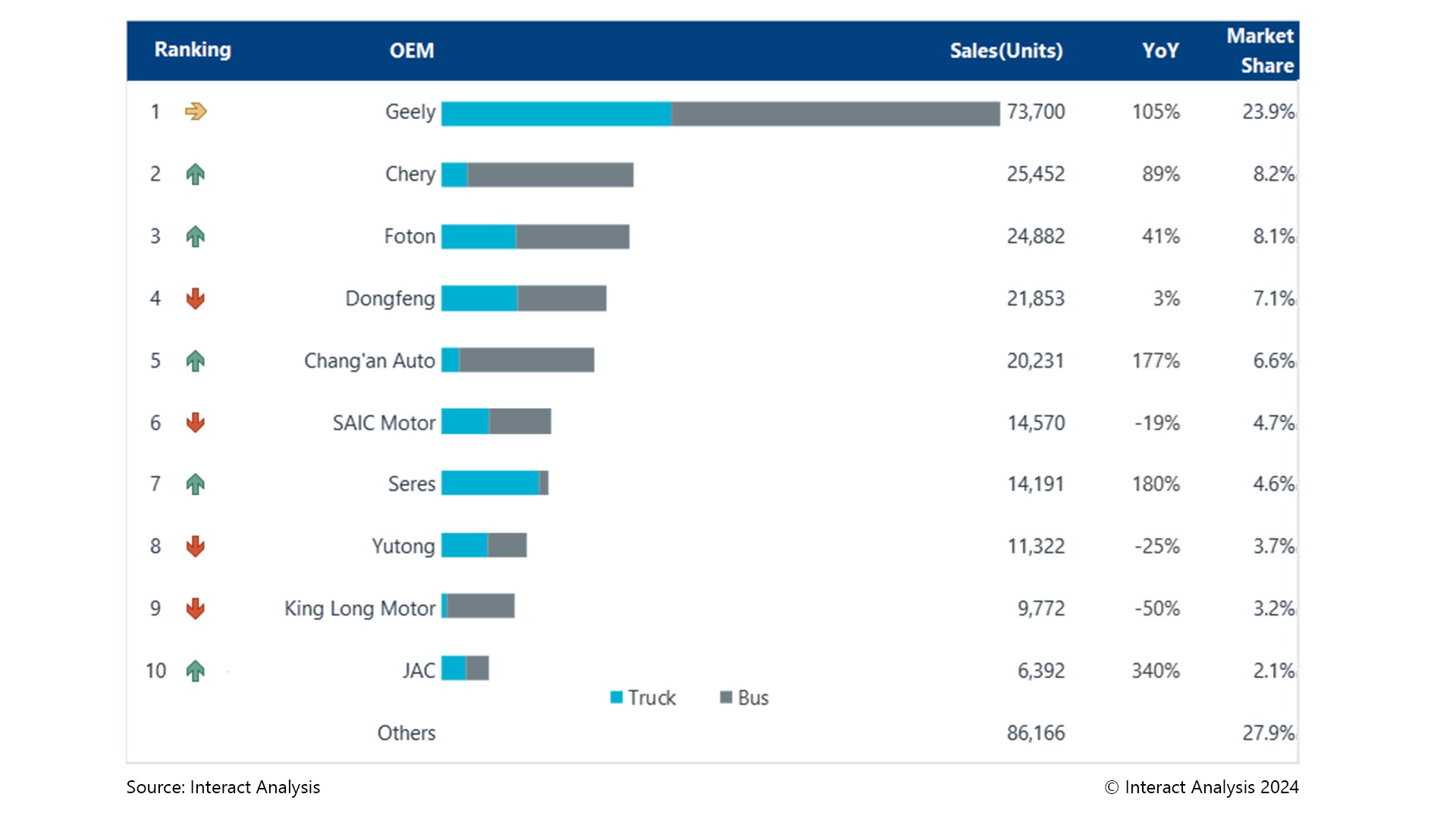

Over 220 OEMs sold new energy buses and trucks in China during 2023, with the top 10 OEMs accounting for around 72.1% of total units sold, a 4.7 percentage point increase from 2022. Among them, sales for the top eight manufacturers all exceeded 10,000 units each.

Geely maintained its top sales position in new energy commercial vehicles for 20 consecutive months, thanks to surging demand for the company’s light-duty trucks and buses. In 2023, Geely achieved total sales of over 73,000 new energy commercial vehicles, representing year-on-year growth of 104.7% and increasing its market share from 15.1% in 2022 to 23.9%.

Chery and Foton – both focusing on sales of new energy buses – secured the second and third positions, respectively, and saw an improvement in their rankings compared with 2022.

In addition to Geely, Chang’an Auto, Seres, and JAC all managed to double their sales in 2023, benefiting from rapid growth in the sales of light-duty commercial vehicles. Chang’an Auto primarily focused on new energy small-sized buses, while Seres and JAC mainly sold new energy light-duty trucks.

The top 10 new energy truck OEMs

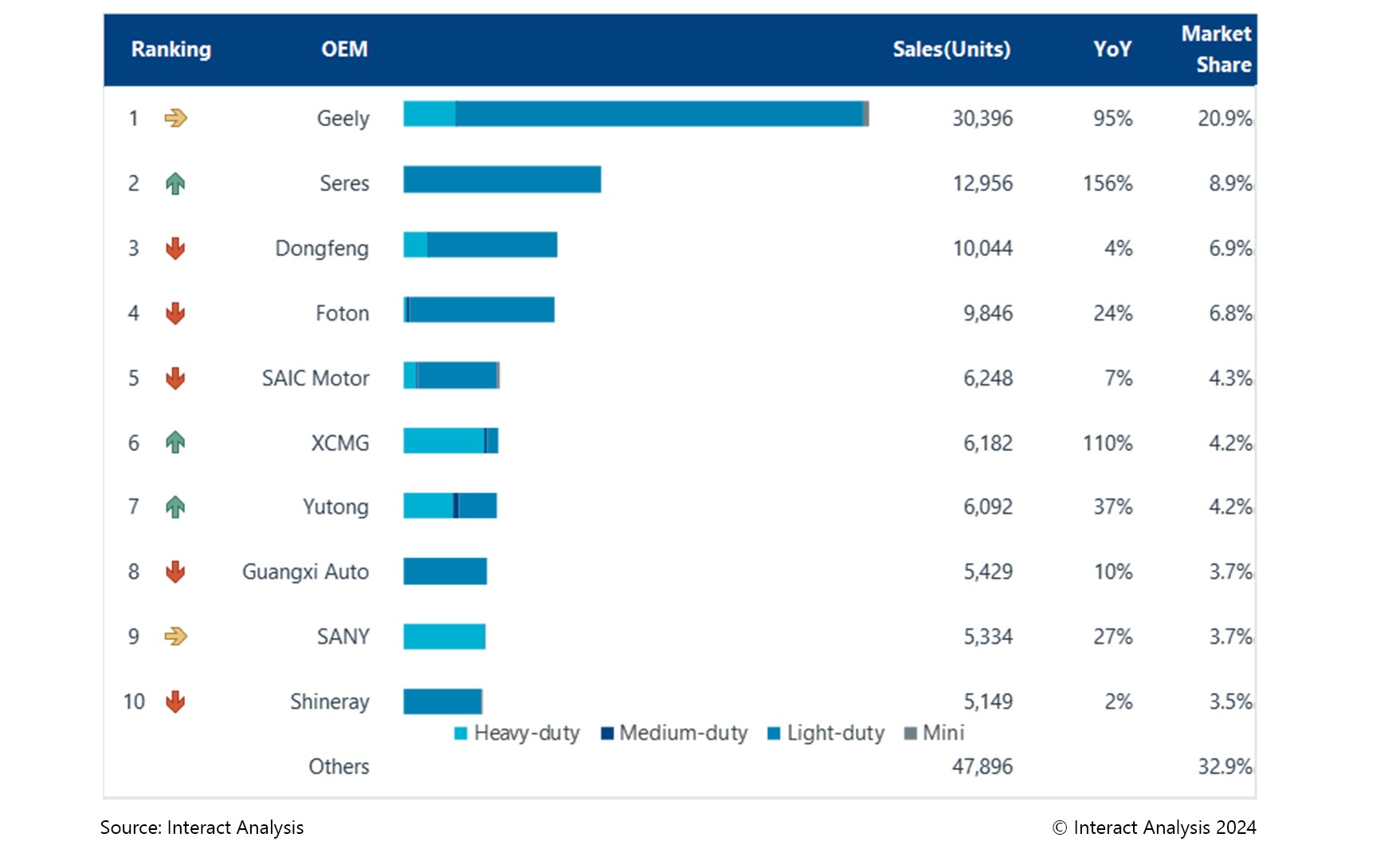

In 2023, over 190 OEMs sold new energy trucks, with the top 10 OEMs accounting for 67% of total sales, up by 1 percentage point year-on-year.

The top ten new energy truck enterprises remained consistent with those in 2022, but there have been changes in the ranking order. The cumulative sales of the top ten manufacturers all continued to grow, with the top three manufacturers each achieving sales in excess of 10,000 units.

Geely led the market by a significant margin with sales surpassing 30,000 units. Seres, whose entire new energy truck sales come from light-duty trucks, achieved the highest growth rate at 156%, jumping from fifth place to second in the rankings. XCMG, specializing in heavy-duty truck sales, benefited from the continuous addition of popular models, leading to a substantial 110% increase in terminal sales compared with 2022. Among the top ten companies, XCMG, Yutong, and SANY primarily sell heavy-duty trucks, while the remainder focus on light-duty trucks.

Furthermore, SANY, ranked ninth, achieved its entire sales from heavy-duty trucks, making it the top performer in new energy heavy-duty truck sales for 2023. InforeEviro secured the top position in new energy medium-duty truck sales with 498 units, although it did not enter the top ten for overall new energy truck sales.

The top 10 new energy bus OEMs

In 2023, 70 OEMs sold new energy buses, and the top 10 companies accounted for 87.6% of total sales, up by 6.8 percentage points year-on-year.

Differences in demand within the large-sized, medium-sized, and small-sized bus markets meant that sales performance of the top ten manufacturers varied, with some experiencing increases and others facing declines. Cumulative sales for the top five automotive companies exceeded 10,000 units each.

Geely was top of the list, with year-on-year growth up by 112%, giving it a market share of 26.6%. Benefiting from the strong sales of small-sized buses, Chang’an Auto demonstrated the fastest growth in the top ten to secure third position. In 2023, Greelto shifted its main sales focus from medium- and large-sized buses to small-sized buses, with sales in the latter category up by 9.7 times compared with 2022. This took the company’s ranking from nineteenth position in the same period of 2022 to tenth place last year.

SAIC Motor, which is primarily focused on the sales of small-sized buses, experienced a significant decline in sales in 2023, impacted by a substantial decrease in sales of its bestselling models. As a result, the company’s ranking also declined.

King Long Motor and Yutong, both specializing in sales of large-sized and medium-sized buses, experienced a significant decline in terminal sales of over 50% in 2023 because of sluggish market demand. Despite substantial drops in the rankings, both companies still maintain leading positions in the new energy large- and medium-sized bus market, securing the top two spots in sales for 2023.