Volkswagen and the semiconductors

The Volkswagen Group is reorganizing its procurement of electronic parts and semiconductors to ensure supply over the long term

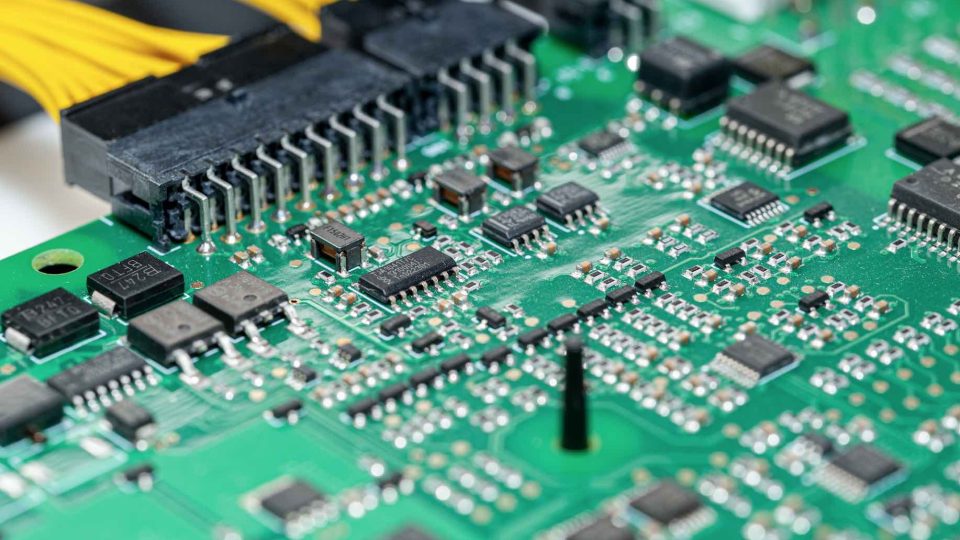

The Volkswagen Group did not just get out of the doldrums of endemic semiconductors latitude. The greatest increase in demand for semiconductors is the result of the increasing electrification of vehicles and the trend towards the growing use of assistant functions through to fully autonomous driving. The corresponding innovations will also result in the use of cutting-edge semiconductors, while the demand for more common semiconductors will remain or even rise further.

Semiconductors value chain according to Volkswagen Group

“A high degree of transparency in the semiconductor value chain – the exact knowledge of the parts used – enables us to better determine the global demand and availability of these components. This is underscored by risk management which, in future, will extend to the level of individual electronic parts and help us detect bottlenecks early on and avoid them. For strategically important semiconductors and even the Group’s own planned developments in the future, we will rely on direct purchasing from the semiconductor manufacturers,” said Dirk Große-Loheide, Board Member for Procurement of Volkswagen Passenger Cars and member of Group management.

A stronger partnership with the suppliers

In the past, electronic components like control units were procured and the Tier 1 suppliers were largely free to decide which parts they used. Going forward, in close collaboration and partnership with Tier 1 suppliers, Group procurement will define which semiconductors and other electronic parts are to be used. “Additionally, this is done across all brands by the Semiconductor Sourcing Committee (SSC) established especially for this purpose, with representatives from the procurement and development departments of the brands as well as from Volkswagen Group Components and CARIAD. Furthermore, the transparency regarding semiconductors means that technical alternatives can be identified and implemented more quickly in the event of bottlenecks. Another positive effect is that a reduction in the diversity of variants in the hardware results in a lower degree of software complexity,” said Karsten Schnake, Board Member for Procurement at Škoda Auto and head of the cross-brand and cross-functional task force COMPASS (Cross Operational Management Parts & Supply Security), explaining the advantages.

The evolution of semiconductor strategy value chain

Vehicle innovations are heavily characterised by the use of semiconductors: in 1978, only eight semiconductors were installed in a control unit of a Porsche 911. Today, a Škoda Enyaq has around 90 control units with some 8,000 electronic components. This development also has an impact on the value of electronic components in the vehicle, the value of which will more than double by the year 2030 from today’s average of around 600 euros per vehicle. According to the Group’s assessment and corresponding analyzes, the importance of the automotive sector as a customer of the semiconductor industry is also increasing. Today, the automotive industry is in 5th place among the major buyers with a global procurement volume for semiconductors of around 47 billion US dollars. By 2030, our industry is expected to secure third place with a market volume of around 147 billion US dollars.