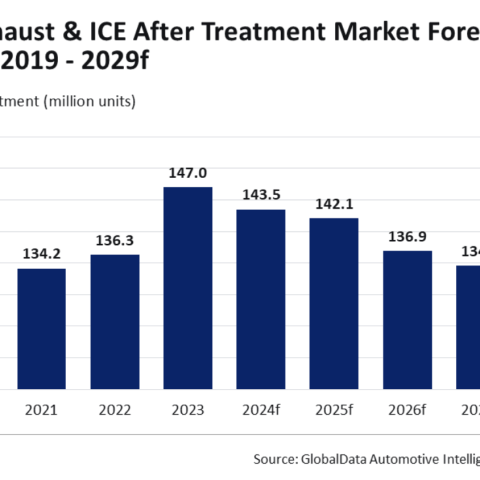

APAC exhaust and ICE’ ATS according to GlobalData

APAC exhaust and ICE after-treatment market to decline at negative 2% CAGR over 2024-29, forecasts GlobalData

The installation of after-treatment systems (ATS) in the Asia Pacific region is showing a significant decline, which does not seem to stop in the near future either. After all, it could not be otherwise, considering the speed at which battery systems are penetrating the Chinese on road sector.

The relentless decline of ATS

China, being the largest market for electric vehicles (EVs), is leading the charge, while other Asian nations such as Japan, South Korea, India, and Indonesia are implementing policies to accelerate the adoption of EVs, which may negatively affect the market for the exhaust and internal combustion engine (ICE) after-treatment sector in APAC. Against this backdrop, the APAC exhaust and ICE after-treatment market is expected to record a negative CAGR of 2.0% over 2024-29, according to GlobalData, a leading data and analytics company. GlobalData’s latest report, “Global Sector Overview & Forecast: Exhaust and ICE after treatment Q3 2024” reveals that the exhaust and ICE after-treatment market is estimated at 143.5 million units in 2024 and is forecast to decrease to 129.7 million units by 2029 in the Asia-Pacific region.

Quoting GlobalData

Madhuchhanda Palit, Automotive Analyst at GlobalData, comments: “The increasing stringency of emission regulation laws is compelling key industry participants to direct their efforts towards research and development (R&D) in order to adhere to permitted emission standards. For example, the most recent emission regulation in India, Bharat Stage VI (BS-VI), which took effect in April 2020, stipulates a sulfur allowance of only 10 parts per million. This has significantly influenced the advancement of ICE after-treatment components, such as gasoline particulate filters, which mitigate particulate matter emissions from direct injection engines in vehicles, and selective catalytic reduction systems.”