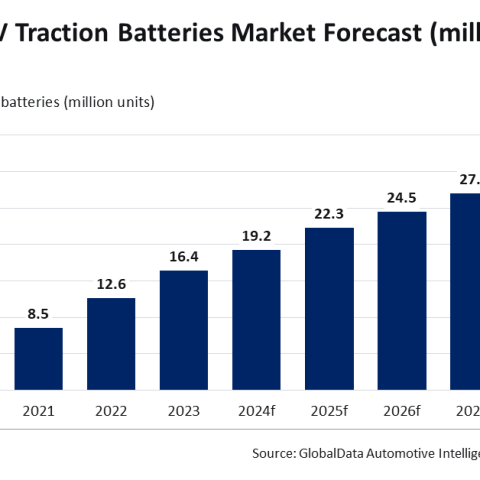

[GlobalData] xEV batteries market to reach 29.9 million units by 2029 in the APAC region

The volume of xEV batteries is projected to increase steadily to reach 29.9 million units in APAC by 2029, recording a compound annual growth rate (CAGR) of 9.3% over 2024-29, according to GlobalData, a leading data and analytics company.

The electric vehicle (EV) market in the Asia-Pacific (APAC) region is experiencing rapid growth, with governments playing a pivotal role in driving the adoption of EVs through supportive policies and incentives. One of the key components of EVs is the advanced xEV batteries, which are essential for powering these vehicles. The volume of xEV batteries is projected to increase steadily to reach 29.9 million units in APAC by 2029, recording a compound annual growth rate (CAGR) of 9.3% over 2024-29, according to GlobalData, a leading data and analytics company.

GlobalData’s latest report, “Sector Innovation Report: xEV Traction Batteries – Q3 2024” reveals that the volume of the xEV traction batteries market is estimated to be around 19.2 million units in 2024, showing a consistent growth trend from the previous years.

Gorantala Sravan Kumar, Associate Project Manager, Automotive at GlobalData, comments: “Asian countries have been proactive in implementing policies that support the growth of the EV market, which in turn drives the demand for advanced xEV batteries. In Southeast Asia, countries like Thailand and Indonesia have emerged as key players in the EV market, thanks to their supportive government policies. Thailand, for instance, has implemented an EV incentive program that has led to a surge in EV sales, positioning the country as a regional hub for electric mobility. Indonesia, with its abundant resources, is also attracting investments in the EV sector, bolstering its automotive industry. The introduction of policies that promote the establishment of charging infrastructure and provide financial incentives for consumers and manufacturers is crucial for sustaining this growth.”

China, a global leader in the EV market, has been driving the transition to EVs through substantial government support. The government’s subsidies for EV manufacturing and sales resulted in making EVs more competitive compared to traditional internal combustion engine vehicles. Additionally, China has invested significantly in charging infrastructure, with plans for further expansion, solidifying its position as a frontrunner in the EV market.

Japan and India are also making significant strides in promoting EV adoption through various initiatives. Japan’s Clean Energy Vehicle subsidy system and India’s Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme are providing incentives to boost EV sales and adoption. These policies, coupled with investments in charging infrastructure, are expected to drive further growth in the EV market in these countries.

Sravan Kumar concludes: “The trends and drivers of innovations in EV batteries in Asia are closely linked to government policies and market demand. As the demand for EVs continues to rise, there is a growing need for advanced xEV batteries that offer higher energy density, faster charging capabilities, and longer lifespan. Asian countries are investing in research and development (R&D) to drive innovation in EV battery technology, with a focus on improving performance and reducing costs. With continued government support, the outlook for EV adoption and battery technology innovation in the region looks promising.”