[Interact Analysis] Indian battery market, between soaring demand and inadequate production capacity

In the latest insight by Yvonne Zhang, Research Associate at Interact Analysis, we found out that the growth of the electric vehicle and energy storage markets in India is driving the development of the domestic battery industry. However, the insufficient capacity of domestic battery cell production and shortages of raw materials are limiting the battery market’s growth.

The rapid expansion of the electric vehicle and energy storage markets in India is driving development of the domestic battery industry. However, insufficient capacity of domestic battery cell production and shortages of raw materials have become key factors limiting its growth. In order to break this deadlock, the Indian government has introduced incentive policies aimed at accelerating the localization of battery cells, attracting domestic and foreign companies to invest in building battery factories. Despite active responses from domestic companies and strong interest from overseas manufacturers in the Indian market, issues related to domestic industry protection and the business environment remain obstacles, resulting in relatively slow development of the domestic battery industry chain.

India’s domestic electric vehicle market is flourishing

In 2019 the Indian government’s NITI Aayog policy think tank set a target to increase the proportion of electric passenger vehicles to 30% and electric commercial vehicles to 70% by 2030, and the Indian government began promoting the development of electric vehicles more actively in 2021, after signing the Paris Agreement on climate change. However, despite government support and rising global demand for new energy vehicles, actual progress has been relatively slow.

In order to protect the domestic automotive industry, the Indian government has imposed high tariffs on imported electric vehicles: tariffs of up to 70% for imported electric vehicles priced below $40,000, and tariffs of 100% for those priced above $40,000. Although this was intended to encourage overseas manufacturers to localize production, the result has been to deter leading electric vehicle manufacturers such as Tesla. This has contributed to a slow development process in the Indian electric vehicle market, particularly given the relative weakness of domestic manufacturers. As of 2023, the penetration rate of electric vehicles in India was only 6.6%, with electric passenger cars accounting for approximately 1.7% of the market, falling significantly short of targets. However, this also implies significant untapped potential in the Indian electric vehicle market.

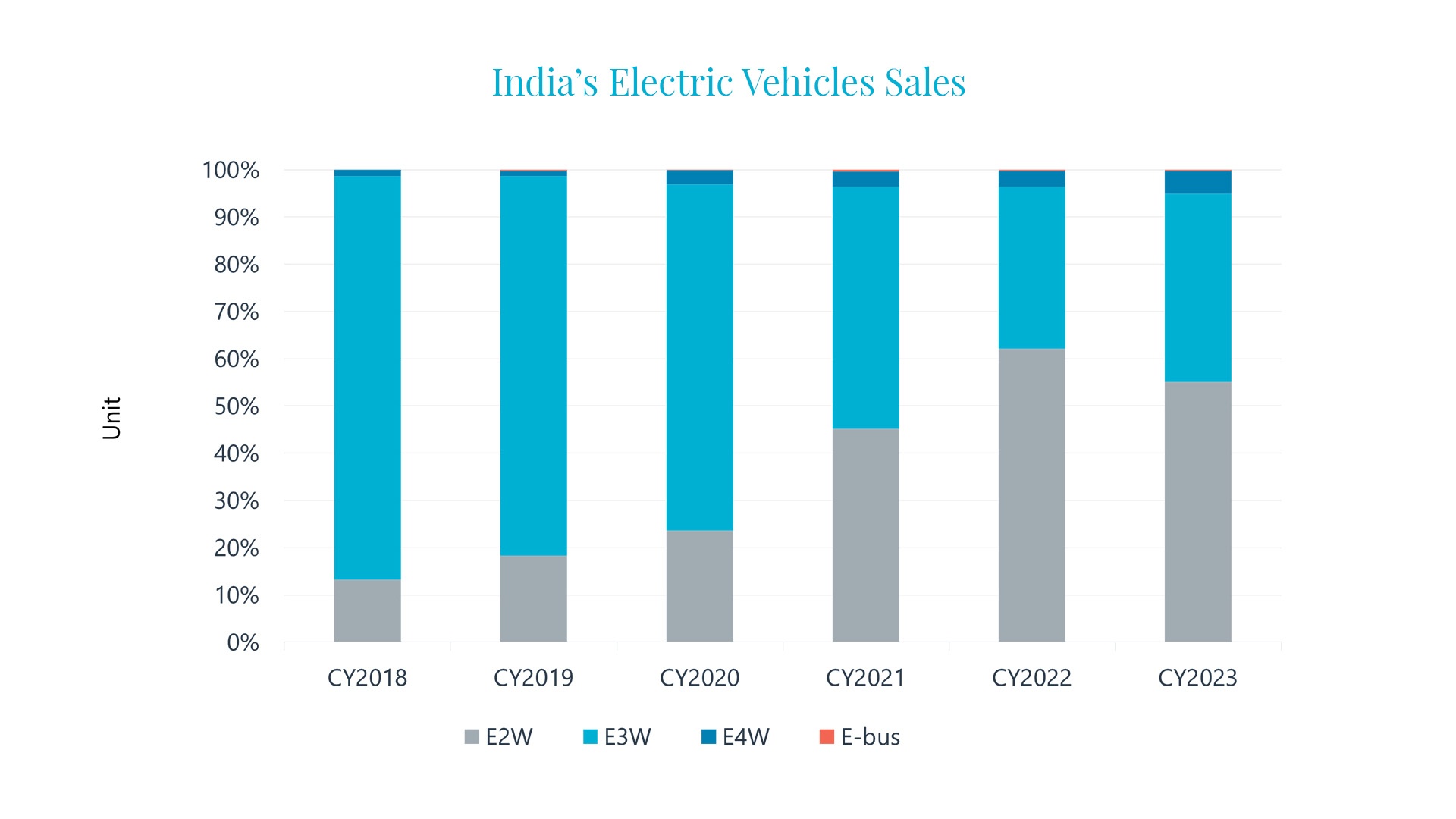

As shown in the figure below, the electric vehicle market in India is still dominated by electric two-wheelers and three-wheelers, with electric four-wheelers and electric buses accounting for a relatively small proportion. Although from 2019 to 2023 the CAGR of these two categories exceeded that of electric two-wheelers and three-wheelers, reaching 102%, it was not until 2023 that the combined proportion of electric four-wheelers and electric buses surpassed 5%.

At the end of 2023 the Indian government stated its intention to gradually implement policies that will reduce import duties on vehicles, but specific details and implementation plans have not yet been released. With the policy still unclear, leading electric vehicle manufacturers like Tesla are still in wait-and-see mode. However, the potential of the Indian electric vehicle market has also attracted some automakers to enter the scene. For instance, in February of this year Vietnamese electric vehicle company Vinfast announced the start of construction on its automotive factory in southern India.

The potential of the energy storage market is enormous

According to a report by the Central Electricity Authority (CEA) of India, it is predicted that by 2030, the demand for energy storage in India will reach 60.63 GW/336.4 GWh, including pumped hydro storage of 18.98 GW/128.15 GWh and electrochemical storage of 41.65 GW/208.25 GWh.

In recent years, the Indian government has introduced a series of incentives aimed at promoting the development of new energy storage technologies. In September 2023, the Indian government approved a scheme called the Viability Gap Funding (VGF) program, which provides a subsidy of 40% of the deployment costs for the winning bidders of energy storage projects through competitive bidding, aiming to reduce the deployment costs of energy storage.

Additionally, the Indian government has allocated funds to support the deployment of approximately 4 GWh of battery energy storage systems, primarily targeting distribution companies, with winning projects required to be operational within 18 to 24 months.

Interact Analysis’ recent report PCS in battery energy storage systems forecasts that by 2030 India is poised to become the world’s third-largest electrochemical energy storage market, particularly within large-scale energy storage technologies such as wind-solar hybrid systems.

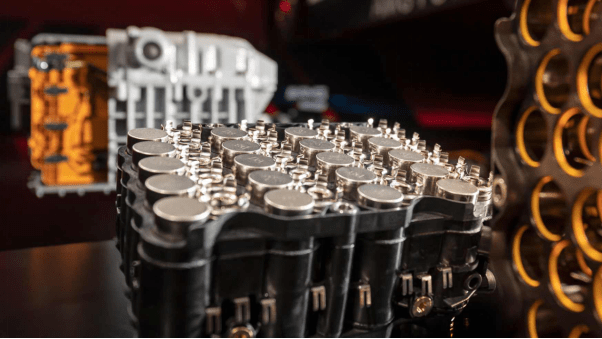

The lithium-ion battery market in India faces limited production capacity

With the gradual expansion of the electric vehicle and energy storage markets in India, the Indian battery market is facing numerous challenges and is unable to meet the demands of businesses.

Firstly, the domestic market lacks raw materials. India does not possess abundant lithium mining resources. According to data from the Indian Ministry of Commerce, from April to December 2023, India imported lithium ores worth $25.5 million, with imports from China accounting for 61.8%. It wasn’t until 2023 that India discovered lithium deposits domestically for the first time. Simultaneously, India is actively seeking international cooperation to acquire more mineral resources. In January 2024, the Indian state-owned company KABIL signed a significant lithium exploration agreement worth 2 billion rupees with the Argentine state-owned mining company CAMYEN. Both parties will conduct lithium exploration activities in five blocks in Argentina.

Secondly, while domestic battery pack production has been rapidly expanding, the production capacity for battery cells remains relatively limited. Among the top ten battery companies globally, only Samsung SDI has a cell manufacturing facility in India with a capacity of 2 GWh, primarily catering to the consumer electronics market. In recent years, numerous companies such as Gotion, Sunwoda and Phylion have entered the Indian market and established pack assembly plants. With the widespread application of lithium-ion batteries in automotive propulsion, domestic manufacturers of electric two-wheelers and three-wheelers in India have also begun transitioning from traditional lead-acid batteries to lithium-ion batteries as their power source. However, due to the relatively small domestic battery production capacity, India still relies mainly on imports to meet market demand. According to data from the Indian Ministry of Commerce, from April to December 2023, India imported lithium-ion batteries worth $22.5 million, with imports from China accounting for 84.5% and imports from South Korea accounting for 10.8%.

The Indian government is actively promoting the localization of battery cell production

To meet the growing market demand and reduce dependence on imports, the Indian government is actively promoting the localization of battery cell production to enhance domestic battery capacity. In 2021, the Indian government officially included the Advanced Chemistry Cell (ACC) project in the Production Linked Incentive (PLI) scheme, allocating 181 billion rupees to incentivize battery companies to localize production in India through subsidies. The planned production capacity is set to reach 50 GWh.

This incentive policy has proven effective. The first round of bidding for the ACC PLI concluded in March 2022, with three Indian companies securing a total capacity of 30 GWh: Ola Electric Mobility Pvt Ltd, an Indian electric vehicle company, obtained 20 GWh, while Reliance New Energy Ltd and ACC Energy Storage, a subsidiary of Rajesh Exports, each secured 5 GWh. These companies will establish factories in Krishnagiri, Tamil Nadu; Jamnagar, Gujarat; and Dharwad, Karnataka, respectively.

Starting from 2023, more domestic Indian companies and businesses from Korea and Japan have announced plans to build battery gigafactories in India. Panasonic plans to construct a 20 GWh factory, while LG Energy Solution and Indian steel conglomerate JSW plan to jointly build a 20 GWh facility. Tata Group’s battery subsidiary, Agratas, announced plans to build a 20 GWh capacity factory in Gujarat. JSW has also announced an investment of nearly $5 billion in the eastern Indian state of Odisha to build electric vehicle and 50 GWh battery projects.

Moreover, the second round of bidding for the ACC PLI commenced in January 2024, and it is expected that more companies will receive capacity allocations, further driving the development of India’s battery industry.

Final thoughts

Countries and regions undoubtedly wish to build domestic supply chains, reduce dependence on imports and avoid falling behind in terms of industrial development. In Southeast Asia, countries like Thailand, Vietnam, and Indonesia have seen numerous electric vehicle and battery manufacturers actively expanding their presence, fostering a vibrant new energy industry. The Indian government announced a reduction in import tariffs for electric vehicles on March 15: vehicles priced above $35,000 will enjoy a 15% reduction in import duties over five years. Additionally, companies committing to invest over $800 million will have a total import quota of 40,000 electric vehicles, with 8,000 vehicles permitted annually. This sends a positive signal, creating a more favorable environment for the domestic battery industry.