[Interact Analysis] Which EV component increased price the most in 2022?

Jamie Fox, Principal Analyst at Interact Analysis, discusses here electric vehicle component pricing. The long-term trend is clear; there will be a decline in the cost of batteries as well as other components which will make vehicles less expensive over time and could lead to upfront cost parity in many cases within this decade.

Jamie Fox, Principal Analyst at Interact Analysis, discusses here electric vehicle component pricing. The long-term trend is clear; there will be a decline in the cost of batteries as well as other components which will make vehicles less expensive over time and could lead to upfront cost parity in many cases within this decade.

Prices of components are increasing

Electric vehicles can be expensive, but the long-term trend is a clear decline in the cost of batteries and other components, which is making the vehicles themselves less expensive over time and could lead to upfront cost parity in many cases within this decade.

Unfortunately, the trend of price declines has gone into reverse into 2021 and 2022 with component prices currently being higher than they were in 2020. Many factors have conspired to create a difficult price environment: supply chain difficulties, supply shortages and raw material costs. These issues have been caused by various issues including war in Ukraine and the COVID pandemic.

Motors increased the most, due to raw materials

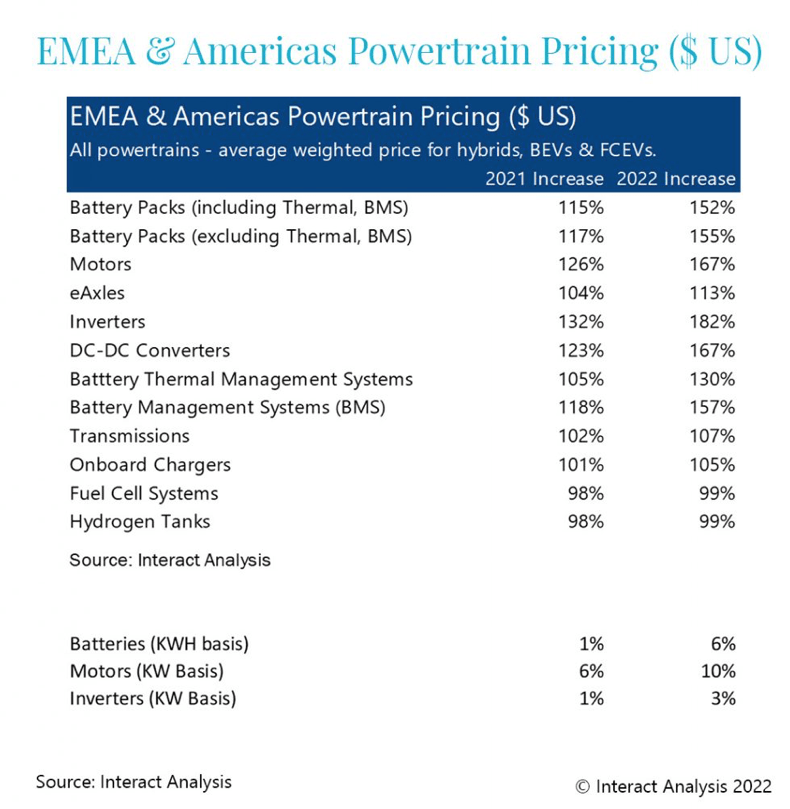

These issues have affected many components but according to the data we gathered motors saw the highest price increase when comparing like-for-like products (i.e. products of the same or similar power, torque, lifetime etc). According to some sources, this is due to this component being affected more by raw materials prices than other components.

On a per KW basis the price of motors increased by 6% in 2021 and is forecast to increase 10% in 2022. Many other components only increased by 0%-3% in 2021 and 3%-6% in 2022.

On an average unit basis, motors increased by 26% in 2021 and 67% (forecast) in 2022 as shown in the table below. The much higher numbers are mainly because the average power of each motor has been increasing due to the production of more powerful vehicles and because in 2022 more larger vehicles are electrifying whereas it was mostly smaller commercial vehicles in 2020.

The price for fuel cells and hydrogen tanks has remained similar. Hydrogen vehicles are not seeing as much of a surge in demand as battery electric vehicles.

Inverters also increased in price

Motors increased the most on a like-for-like basis as explained above, and therefore they are the product that has seen the largest increase of total value per vehicle. However, it depends how you count! The table shows that inverters increased slightly more when considering the average product sold. This is because from 2020 to 2022 there has been an increase in vehicles using multiple motors. Since in some cases two motors are required, the cost of each motor can be less to deliver the same overall power and performance for the vehicle.

The increasing size and performance of electric vehicles also explains the majority of the cost increases for other products shown in the table, while the price increase for like-for-like products again accounts for a smaller amount.

Price decline should resume

These increasing price trends are not expected to continue. In the middle and second half of the decade the trend of increasing power and battery size in a vehicle should stop, while price erosion for like-for-like products is forecast to resume.

Component price declines, combined with increasing economies of scale for electrified vehicles, will drive down prices so that electric vehicles cost a similar amount to conventional vehicles by the end of the decade.

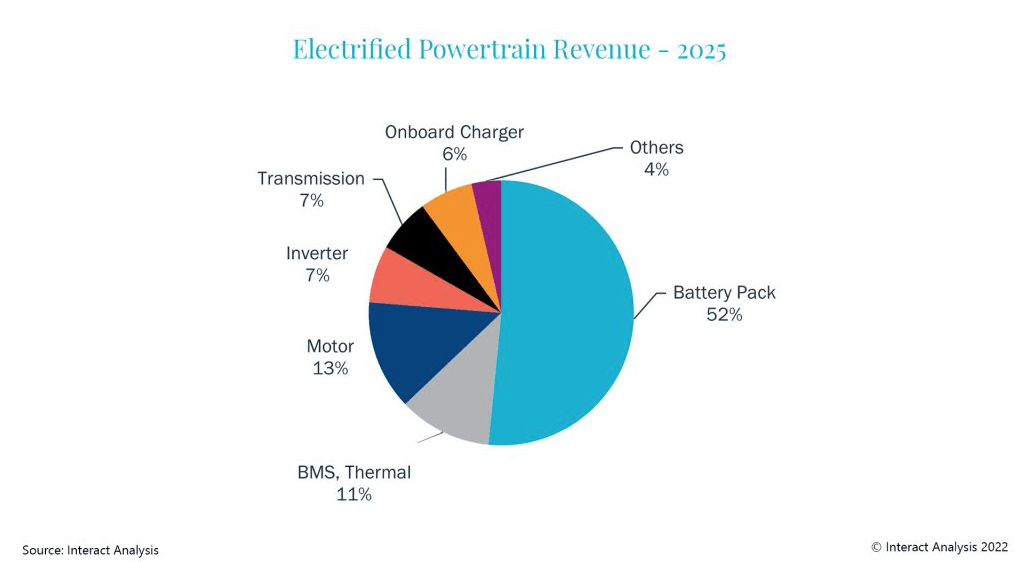

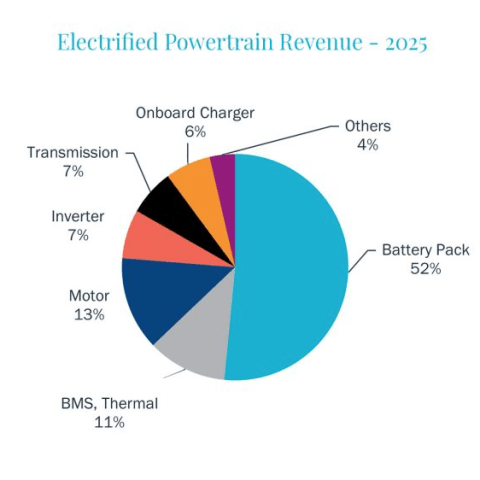

Battery pack still dominates

It is worth highlighting that increases in motor and inverter price do not have a large impact on the total powertrain value. The battery pack is by far the most expensive component, so price increases of other components are only critical for vendors of those components, not for vendors of entire powertrains or vehicles.

The pie-chart below illustrates how the value of a battery pack dominates over other components. Therefore, while its percentage increase may be lower than some other components, it is the increase in price of battery packs has most affected the overall cost of a powertrain and a vehicle, meaning most electric vehicles have not been able to reduce their pricing in 2022. Over the coming years, a large amount of additional battery production capacity will come online, including in Europe and North America. Demand will also grow but, overall, we forecast that battery supply and demand will, over time, be matched fairly well, leading to steady reductions in the cost of a battery pack for much of the rest of the decade.

China is expected to have lowest pricing, with Europe and Americas being similar. Requirements to purchase and produce locally to qualify for subsidies will likely make battery pack and perhaps other component pricing slightly higher in the US. Click here to read the full report.