Global chemical sector: an in-depth analysis (Part II)

‘Global chemical sector: an in-depth analysis’ is the title we have chosen for a prestigious contribution coming from Joseph Chang, Global Editor, ICIS Chemical Business. In the first part of the article, published last week, we talked about the oscillations of the so-called Purchasing Managers’ Indexes (PMI) as for the US, Europe and China, with […]

‘Global chemical sector: an in-depth analysis’ is the title we have chosen for a prestigious contribution coming from Joseph Chang, Global Editor, ICIS Chemical Business. In the first part of the article, published last week, we talked about the oscillations of the so-called Purchasing Managers’ Indexes (PMI) as for the US, Europe and China, with a special focus on the Eastern giant. Now, let’s restart from the oil forecasts.

Global chemical sector: oil forecasts slashed

Meanwhile, analysts are taking down crude oil price forecasts for 2020 and beyond.

«We lowered our already-bearish oil priced deck further as coronavirus containment cuts into global oil demand, while the balance is getting longer on the supply side due to the OPEC+ schism», said Ed Morse, global head of commodities at Citi, on a 31 March conference call hosted by the NABE (National Association for Business Economics). «We now see Brent averaging $30/bbl this year and $17/bbl in Q2».

In his base-case scenario, Morse sees Brent recovering to about $42/bbl by Q4 2021, still far below the $60+/bbl level before the crude oil crash in late February to March. The rapid shuttering of business activity in Europe and North America, even as China is recovering, should lead to a hit to demand on the order of 16m bbl/day or more in Q2 and an overall decline of 8.7m bbl/day in 2020 in Citi’s base case, said Morse.

In his bear case, crude oil demand falls by around 20m bbl/day in Q2, and 10.6m bbl/day for all of 2020.

IMPROVING FUEL EFFICIENCY OF AN INTERNAL COMBUSTION ENGINE

Global polyethylene margins

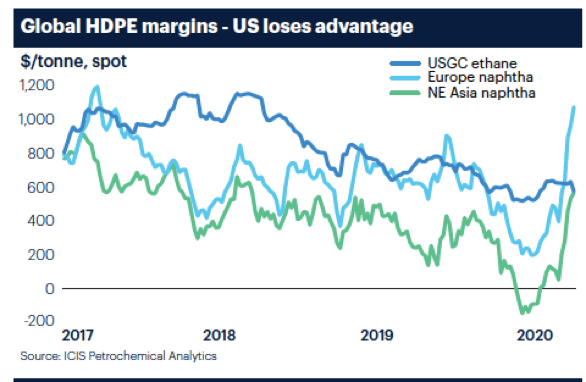

The dramatic drop in crude oil prices has turned everything on its head, the US petrochemical cost advantage in particular. «The ethane advantage US producers had is gone. Lower oil means lower naphtha and lower European production costs, so the once advantaged US is not advantaged anymore», said O’Connor.

This presents a problem for US polyethylene (PE) producers in particular who have ramped up capacity with worldscale cracker projects for the export market. «It all depends on what the price of crude oil is long term», said Sheehan. «Crude oil would have to get back above $50/bbl for some of these large projects to make sense economically and I’m not optimistic about a return to $50 anytime soon».

«On capacity additions in the US, a lot of them are being slowed down or postponed. We’re seeing this across the board, not just in the ethylene chain. Many companies are announcing that they’re reviewing and assessing their capital spending plans for 2020 and if the crisis were to continue in 2021, we would probably see the same thing next year», he added.

In the meantime, with the plunge in oil and naphtha feedstock prices, integrated PE production in Europe is seeing renewed profitability, completely flipping the US advantage.

European spot high density PE (HDPE) margins using naphtha feedstock have rocketed to $1,069/tonne as of 27 March, according to ICIS Petrochemical Analytics. That compares to $574/tonne for US HDPE using ethane feed. Asia HDPE margins using naphtha were $565/tonne, running neck and neck with the US now after being negative through much of November and December 2019.