[Interact Analysis] Permanent magnet motors to gain share in electrified off-highway by 2027

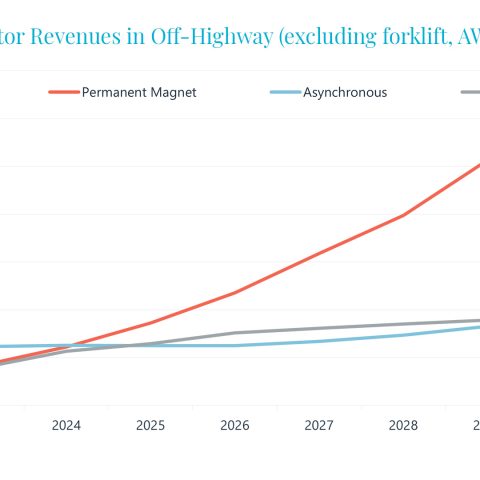

According to the latest report by Jamie Fox, principal Analyst at Interact Analysis, permanent magnet motors are expected to reach a 52% share of off-highway motor revenue by 2027, before increasing to 63% in 2030. Total revenue for permanent magnet motors was $84 million in 2023, which is expected to increase to $318 million in 2027 and $615 million in 2030.

According to Interact Analysis’ latest industry research, permanent magnet motors are expected to reach a 52% share of off-highway motor revenue by 2027, before increasing to 63% in 2030. This excludes forklifts and aerial work platforms (AWPs). Total permanent magnet motor revenue was $84 million in 2023. It is forecast to increase to $318 million in 2027 and to $615 million in 2030.

Motor types can be asynchronous, permanent magnet, or switched reluctance. In forklifts and AWPs (scissors and boom), asynchronous motors are preferred. For other applications, all types are common.

Permanent magnet motors are more expensive than other motor types due to the raw materials used in their manufacture, but they have good power density and efficiency. Motors may become slightly more efficient over time, but many are already over 90% efficient.

Switched reluctance motors operate by switching the magnetic reluctance in the motor’s stator and rotor to generate torque. They don’t use rare-earth magnets, making them more cost-effective and sustainable. These motors also tend to be more durable and better suited to harsh environments.

Switched reluctance motors resist heat build-up well but can have vibration and noise problems. This latter point might explain why switched reluctance motors are rare in on-road applications but are sometimes used in off-road scenarios. It may make sense to use them in noisy, rugged environments where additional noise will not cause concern.

Permanent magnet motors market share is rising

However, over time, we forecast the permanent magnet motors market share to increase and form the majority of shipments and revenue (but only if we exclude forklifts and AWPs).

At present, some of the machines that use permanent magnet motors – such as tractors and medium and large size excavators – have low volumes, but they will start to contribute more market share over the coming years. Permanent magnet motors are more commonly used in larger vehicles and therefore their share of the total off-highway market will increase as larger machines start to electrify (so far, most fully-electric off-highway machines are smaller). In addition, permanent magnet motors are forecast to become more widely used in mini and small excavators.

The growth of permanent magnet motors that we forecast is not yet a done deal. There is still competition between different technologies and the potential for the market to change, with a minority of industry experts that we interviewed projecting a more even balance in the future.

Interact Analysis’ motor forecast includes both traction (drive) and work function motors, and motors used in hybrid vehicles and diesel-electric vehicles as well as fully electric vehicles. In off-highway, motors often driven a hydraulic pump rather than just powering the vehicle directly. In future generations of machines in the 2030s, we think this will be less common as more machines will fully electrify without hydraulics.

Axial flux motors: the hot new trend?

Axial flux motors, which are a type of permanent magnet motor, have a different configuration to other motor types because the magnetic flux runs parallel to the rotor; unlike radial flux motors where it runs perpendicular. This results in a flatter and more compact motor design. Radial flux designs tend to be cheaper than axial flux motors.

Motors can also be integrated with other products, such as inverters. However, in practice this usually amounts to two products sharing the same housing rather than a truly unified combined product. Integrated systems, which are in the minority, save space overall and reduce the cost of cables and connectors. eAxles (when motors are integrated with a transmission, next to the axle) are more common on-road than off-road.

The price range of motors, covered in detail in Interact Analysis’ off-highway powertrain report, is wide. This is partly due to very different sizes of machines. However, even on a per kW basis, there are sometimes substantial differences. Some of this can be explained by other factors – such as torque and quality. However, sometimes it is the result of negotiation, profit margin, and the scale and efficiency of manufacturing operations. This will change over time as prices for equivalent products get closer, but for now it is a good idea to compare several different suppliers.