France transportation and construction: a loud of investments

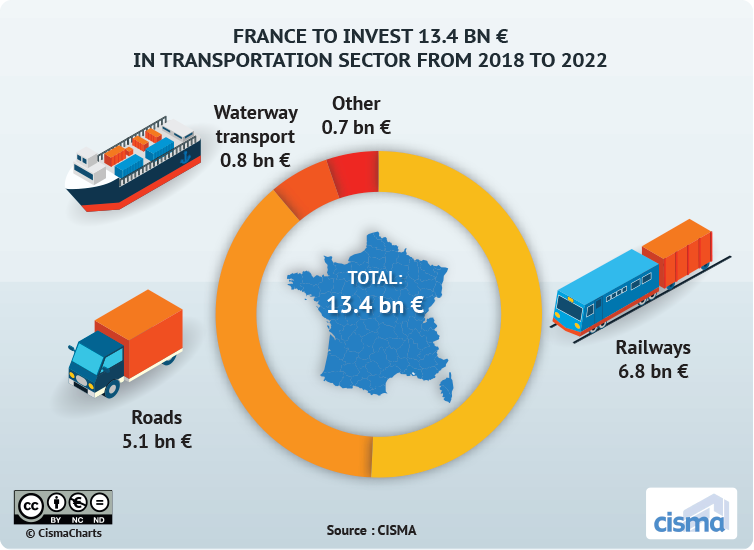

France transportation. €13.4 billion from 2018 to 2022 France transportation will invest €13.4 billion from 2018 to 2022, more than half of which will be for railways. This will be a great news to french economic growth in terms of occupation as well as internal demand. On September 11, the French government outlined his infrastructure […]

France transportation. €13.4 billion from 2018 to 2022

France transportation will invest €13.4 billion from 2018 to 2022, more than half of which will be for railways. This will be a great news to french economic growth in terms of occupation as well as internal demand.

On September 11, the French government outlined his infrastructure spending priorities for the decade to 2028. The government’s program has an initial budget of €13.4bn covering the period to 2022. 5.1 billion euros will be allocated to the renovation and construction of roads.

But, the French government is giving priority investment at key rail hubs outside Paris. 51% of the budget is dedicated to rail spending which is to be focused on the ‘everyday needs of users’.

While its core focus is ‘everyday transport’, the government is not turning its back on ‘major new rail infrastructure projects between cities’.

Further discussions are to be held with the regions to outline the delivery of priority schemes such as the Toulouse – Bordeaux high speed line. The government will also ‘honour its commitments at a European level’ to the planned new line between Lyon and Torino.

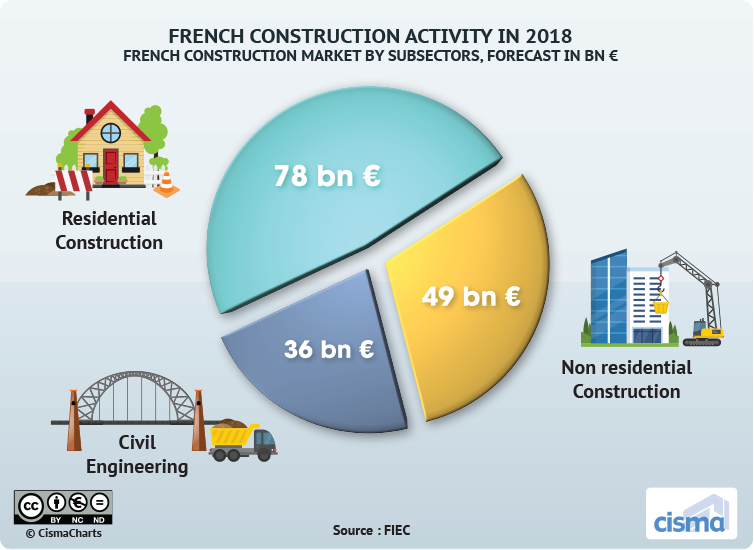

French construction activity in 2018

French construction activity also increased by 4% in 2017, after the first signs of recovery observed in 2016. In 2018, production will increase, but at a more moderate pace (+2.6%).

Activity is expected to grow at a much slower pace in 2018 (+3.4%) due to some supporting programs which will be cut, the forecast shows a loss of 10,000 dwelling starts due to two main factors. On the one hand, incentives, such as the Zero Rate Loan (« PTZ ») and the rental investment product « Pinel », will be refocused on areas where the demand for housing is the strongest.

The reforms will also affect the social housing sector with an increase in the reduced VAT rate and a drop in revenue from rent. On the other hand, the market will suffer from the global deterioration in household income because of a sustained rise in house prices, while credit conditions will not improve.

After years of decline, non-residential construction recovered in 2017 with growth of 3,7%. The growth should continue in 2018, according to the robust figures for permits granted at the end of 2017. Overall, in 2018, non-residential construction should increased by 8,9% in volume, but the level of activity in 2018 will remain low compared to the past.

All market segments, excluding agricultural premises, should contribute to this growth: industrial buildings will perform the most strongly (+16,9%), followed by offices (+9,4%), administrative buildings (+7,1%) and finally, retail stores (+1,5%).

The French civil engineering sector is gradually recovering from the crisis. In 2018, civil engineering turnover is expected to continue rising (+4% in nominal terms). One major infrastructure project, namely the Greater Paris project, will boost activity and generate 1.2% in additional growth. Excluding this project, the outlook remains positive (+2,8%).

Activity will likely be driven by local government investment spending, private investment and ongoing infrastructure projects (the French high-speed broadband plan, the French motorway plan, etc.). Beyond 2018, the French mobility law, which will be subject to a vote by Parliament before end of this year, will deeply influence the industry outlook in the long run.