According to IEEFA, LNG is one of the antidotes to the gas’ shortage from Russia

The EU is betting on efficiency measures and increased LNG imports from non-Russian sources as part of a strategy to cut its dependence on Russian gas by at least 155 billion cubic metres (bcm) well before 2030

We report on the IEEFA’s assessment of LNG as a solution to reduce the problems caused by the cut-off of CNG supplies from Russia. Ana Maria Jaller-Makarewicz, energy analyst for IEEFA’s Europe team, is an international energy consultant with more than 25 years of experience in power, and natural gas markets and industry.

Diversify sources, including LNG, to riduce the Russia stop to the CNG supply

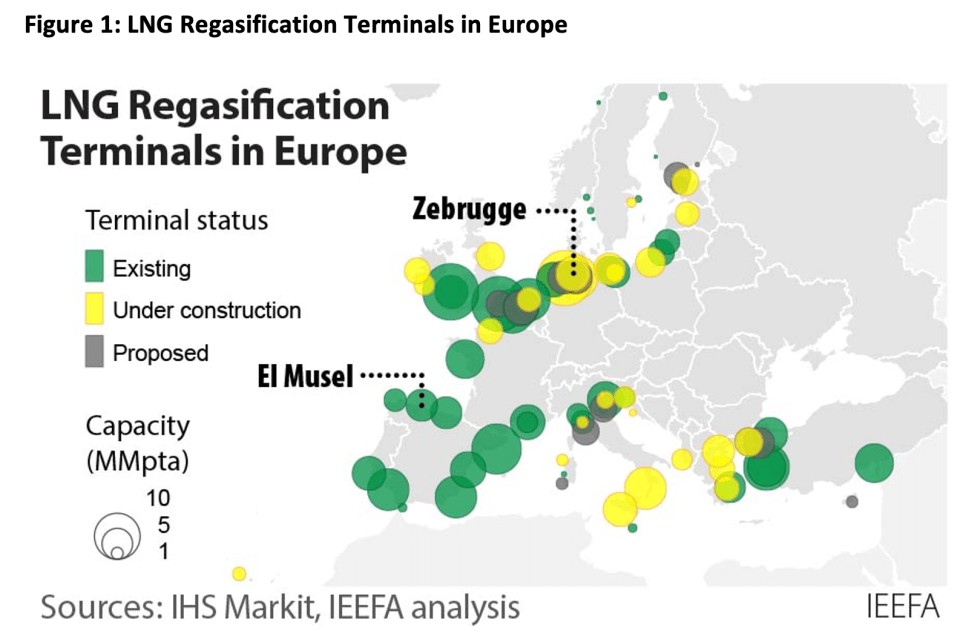

“Diversifying away from Russian gas has become Europe’s top priority following the outbreak of the war in Ukraine. However, two liquefied natural gas (LNG) terminals sitting thousands of kilometres apart, El Musel in Spain and Zeebruggee in Belgium, tell the story of how a lack of coordination across EU member states continues to benefit Russian gas exports at the expense of European consumers. The EU is betting on efficiency measures and increased LNG imports from non-Russian sources as part of a strategy to cut its dependence on Russian gas by at least 155 billion cubic metres (bcm) well before 2030. Additional LNG volumes will be handled via Europe’s vast infrastructure network, which consists of 29 operational LNG terminals, 33 LNG import terminal projects that are currently under construction or in the planning stage, and one that has been mothballed. The case of El Musel and Zeebrugge suggests that increased coordination among member states is needed to handle LNG volumes promptly and efficiently, and to avoid incurring unnecessary costs for the construction and maintenance of redundant gas infrastructure.

El Musel LNG Terminal: from Spain to whole Europe

El Musel LNG Terminal in Asturias, Spain, has the capacity to store 300,000 cubic metres (cbm) of LNG, divided into two tanks of 150,000 cbm each. The terminal was completed in 2013 and was immediately mothballed due to lack of gas demand. Over the course of almost 10 years, Enagás, Spain’s monopoly gas transmission system operator (TSO), has been receiving an annual fee for maintaining El Musel, so that the terminal could be swiftly brought into service if required. Since 2021, the revenue allowed has been €24.9 million per year. In April 2022, the Spanish government announced plans to re-open El Musel and help ease Europe’s energy crunch. The terminal is expected to receive LNG cargoes and store the LNG for re-export to other countries in Europe, mainly Germany, without entering Spain’s gas network. In July 2022, Enagás received an administrative authorisation from the Ministry for the Ecological Transition and the Demographic Challenge to activate the terminal. El Musel is set to become operational in early 2023, with the first tank expected to come into service in January and the second one in March. Bringing a plant into operation that has been mothballed since 2013 will require significant investment. However, neither Enagás nor the Spanish regulator Comisión Nacional de los Mercados y la Competencia (CNMC) have disclosed how much it will cost to reactivate El Musel. El Musel constitutes Spain’s only mothballed LNG terminal. There are six terminals that are currently in operation: Barcelona, Huelva, Cartagena, Bilbao, Segunto, and Mugardos. Their total combined LNG storage capacity is 3,371,000 cbm LNG. All six terminals in Spain have continued receiving Russian LNG in 2022. Over the last 2.5 years, the utilisation rate of the LNG storage tanks in Spain has been around 50%, peaking to 77% in October 2021 and 72% in June 2022. This shows Spain still has storage available in its operational LNG terminals, and it calls into question the wisdom of reactivating a mothballed terminal mainly due to its storage capacity when there is available LNG storage capacity elsewhere.

And a Belgian case study: Zeebrugge LNG Terminal

As detailed in a previous IEEFA report, gas pipeline operator Fluxys Belgium invested €91.3 million in infrastructure projects in 2019. Almost 80% was spent on LNG infrastructure projects, mainly on the construction of a fifth LNG storage tank at the Zeebrugge LNG terminal serving the 20-year transshipment contract with Yamal LNG, whose shareholders are Novatek (Russia), TotalEnergies (France), China National Petroleum Corporation, and the Silk Road Fund (China). LNG transported by icebreaker LNG carriers from the production terminal in Sabetta in Yamal is transhipped to conventional LNG carriers at Zeebrugge to be sent to other markets. Yamal LNG uses this route via Zeebrugge mainly during the winter months when icy waters make it difficult for LNG tankers to reach Asian customers located to the east of Russia. As illustrated in Table 1, the majority of transhipped cargoes are sent to Asia and few to Turkey, Spain and Italy. During the summer months, the 180,000 cbm LNG storage tank utilisation rate is low or none. There were no transhipment operations in Zeebrugge in July 2022, and few transhipment operations taking place in August and September 2022. The storage space of the fifth tank is reserved by Yamal LNG for a 20-year period and is therefore not currently being utilised for security of supply purposes. Furthermore, information concerning the utilisation ratio of the fifth tank is not publicly available. It is very possible that even though the storage tank is reserved, it is not being utilised at all and is sitting idle for large periods of time.