Webasto and the future of mobility

Holger Engelmann, Chairman of the Management Board of Webasto, during the automotive supplier’s annual press conference in Munich, explained: «2018 was not a particularly inspiring year, but it was a very important one in terms of strategic decision making for Webasto». Webasto 2018 recap Webasto Group in 2018 generated sales slightly below the previous year’s […]

Holger Engelmann, Chairman of the Management Board of Webasto, during the automotive supplier’s annual press conference in Munich, explained: «2018 was not a particularly inspiring year, but it was a very important one in terms of strategic decision making for Webasto».

Webasto 2018 recap

Webasto Group in 2018 generated sales slightly below the previous year’s level, at 3.4 billion euros. Of this, sales of sunroofs, panorama and convertible roofs accounted for 2.8 billion euros (82 percent). Sales of heating and cooling solutions accounted for almost 600 million euros (17 percent). Sales by the start-up division accounted for almost 20 million euros (one percent). On a regional level, 42 percent of Webasto sales were attributable to Asia, 41 percent to Europe and 17 percent to the Americas.

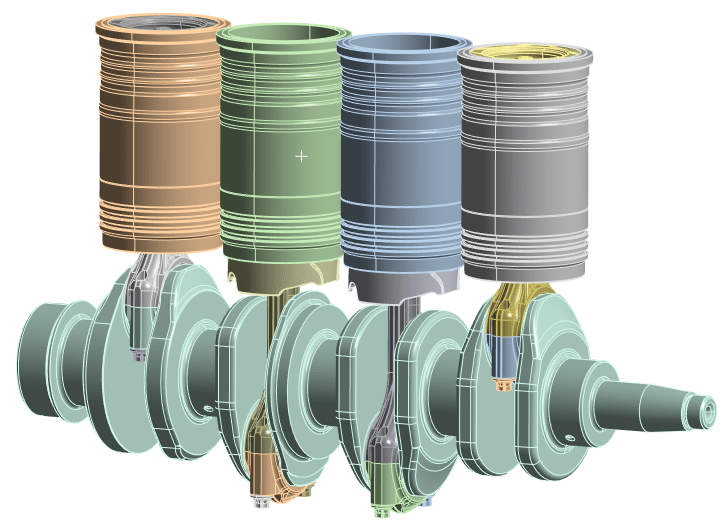

Webasto main focus during the last year was to enhance its technological division, looking towards the development over the long term. This is why it spent almost 271 million euros on R&D. Expenses that went mainly into product development for battery systems, charging stations and electric heating.

Looking at the long-term future direction, investments went also into buildings and plants. In particular, for the establishment and expansion of production capacities in all regions.

Holger Engelmann added: «As we announced last year, we are investing a total of 600 million euros into our strategic development within three years. In the first year we already made advance payments amounting to some 210 million euros. In the course of our strategic development we are also investing in the establishment and expansion of key professional skills. Most of our new colleagues are working in the new fields of business, are strengthening the company’s expertise in the area of electronics or are contributing to capacity expansion in the area of roof systems, particularly in Mexico and China».

New organizational structure

Since the beginning of 2019 Webasto Group changed its structure into three globally active business units:

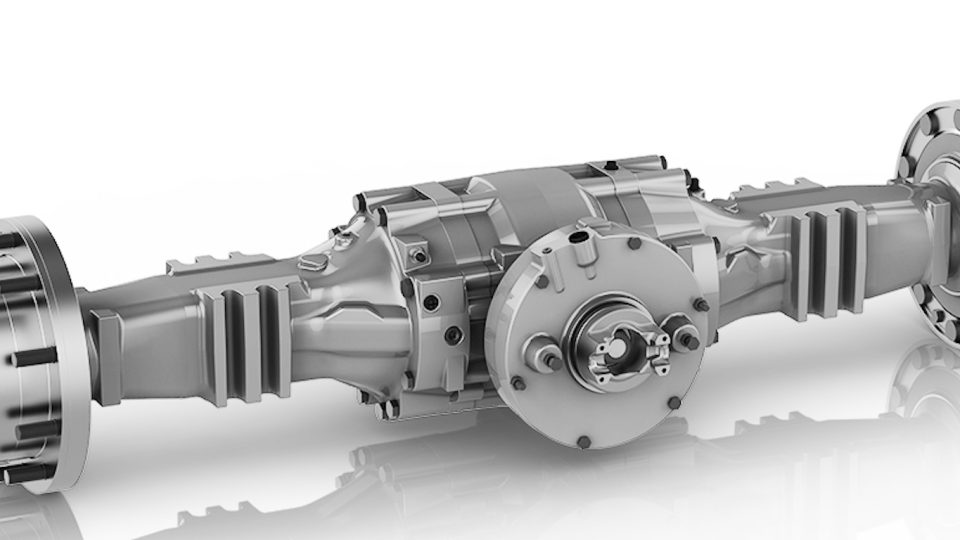

Roof & Components: development and production of sunroofs, panorama and convertible roofs. Energy & Components: development and production of battery systems, charging solutions and electric and fuel-operated heating systems. Both units work together to serve the same target groups: car and commercial vehicle manufacturers. The third unit, Customized Solutions, offers solutions and services for end customers, trade partners and manufacturers of special vehicles.

This new structure, on the one hand, strengthens the customer focus with customer groups. On the other hand, the organization is retaining the strong product focus in the core business as well as in the new business areas. Holger Engelmann explained: «The new organizational structure allows us to leverage the existing structures better than before to the new business areas and with that grow this business rapidly. Furthermore, we can achieve synergies through the flexible and global use of resources».

Following the introduction of the new organizational structure at the beginning of 2019, an important focus will be on the expansion of standardization.

A look at the probable future

The forecast for this year is tied to the previous year’s performance. Sales during the first quarter of 2019 matched last year levels. The profit margin for the first quarter was below the year-on-year figure as a result of the high level of investment.

Full year expectation: against the backdrop of investments in the new fields of business and the acquisition of the joint venture shares from long-standing South Korean partner Donghee, Webasto is expecting an increase in sales and a profit margin slightly below the previous year’s level.

Holger Engelmann, summing up the plans for the future, said: «We are steering our way into the mobile future with drive and innovative strength and have set ourselves the objective of doubling our sales by 2025».