IDTechEx: Total Cost of Ownership will fuel the EV construction industry

IDTechEx’s report “Electric Vehicles in Construction: Technologies, Players, Forecasts” by Pranav Jaswani, Technology Analyst at IDTechEx, provides a deep and granular analysis of the fast-growing electric construction machine industry.

There are many facets of an electric construction machine that make them an attractive option for the wider industry. Machines can operate with zero local emissions and can go a long way to assisting a company’s decarbonization goals and creating a safer environment for workers. They run with very little noise, which reduces noise complaints and eases communication. In spite of these benefits, IDTechEx’s “Electric Vehicles in Construction 2024-2044: Technologies, Players, Forecasts” report finds that financial savings in the total cost of ownership (TCO) of machines will be the primary benefit that drives the electrification of the industry.

Electric machines run with lower operating costs

Electric construction machines are now sufficiently developed, and achieving performance parity with diesel is no longer a concern. Instead, potential customers are more engaged with the degree of savings that an electric machine could offer them. These machines can save on two of the biggest components of TCO – fuel and maintenance.

The use of electricity for charging machines instead of diesel fuel can save thousands of dollars per machine per year in operating costs. IDTechEx has calculated that an average 20-tonne excavator will consume 13,000L of fuel per year – roughly US$13,000 worth at global average diesel prices. Charging an electric machine of the same size would cost just over half that at only US$6,690 per year (using a global average electricity price of US$0.15/kWh). This creates huge savings potential for machine operators, as much as US$75,000 over a full machine service life.

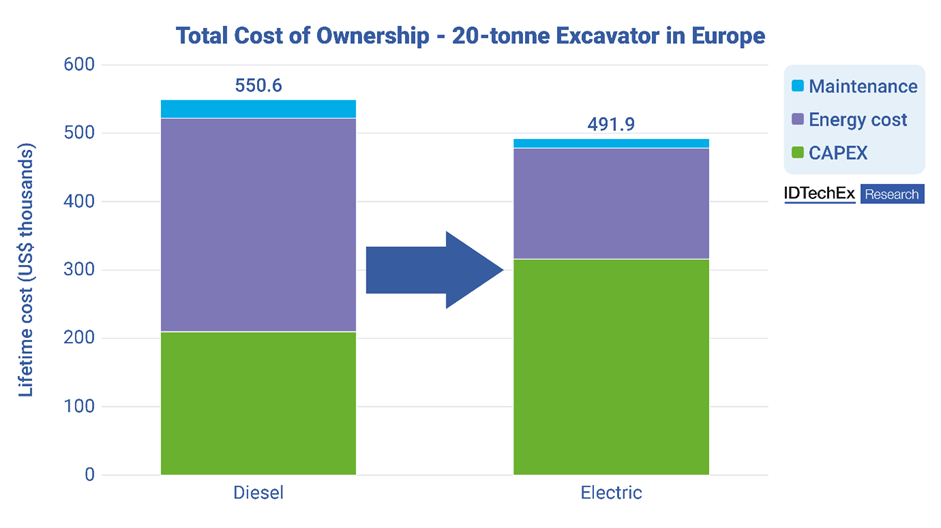

As machines grow in both size and uptime, so do their fuel bills, creating the opportunity for even greater savings through electrification. The regionality of energy prices will make a difference as well. IDTechEx’s estimates for prices in Europe are as much as US$2/L diesel and US$0.30/kWh electricity. At these price points, the electric 20-tonne machine will save US$12,620 a year over the diesel one. Such considerable benefits should push construction operators in the direction of electric models.

On the maintenance front, electric machines replace mechanical driveline components with electric ones, which have far fewer moving parts and require less general maintenance. This also does away with oil and filter changes, which add cost and downtime to a machine’s schedule. IDTechEx has found that electric machines can cut maintenance costs by up to 50% compared to diesel. For a 20-tonne excavator, this adds up to nearly US$15,000 over its lifetime.

Compared to the energy savings from the same machine, maintenance costs will not be the critical factor in the financials of a 20-tonne excavator. However, smaller machines that use less energy (e.g., mini-excavators and compact loaders) don’t save as much on fuel, and maintenance will be a more influential source of savings. A 3-tonne electric mini-excavator saves nearly as much in maintenance costs as it does in fuel compared to an equivalent diesel model.

In areas with emissions charges, often found in city centers, electric machines are not charged for their zero-emission operation, which adds another stream of savings for construction companies to benefit from. For example, London’s Ultra Low Emissions Zone charges £12.50 daily for every high-emitting vehicle.

Many of the emissions charge zones currently in place do not include construction machines in their restrictions, but this is starting to change, and zones that include all emitting equipment are set to become more commonplace. In the future, this will be another significant contribution to machine economics.

High prices are a limitation for electric machines

With all the savings that they can achieve, why haven’t customers taken up electric machines en masse? In reality, the industry’s relative youth means that electric machines still come at a very high capital cost. This can be quite off-putting for many potential buyers, and it must be balanced out by the savings in operating costs for an EV to be worth the outlay.

The main contributor to high price premiums is the cost of batteries and electric drivetrain components such as motors and power electronics. The relatively early stage of development of the overall industry means production volumes are quite low, and OEMs are having to spend more on batteries. IDTechEx’s conversations with industry players suggest that battery pricing is now around US$300/kWh but was as much as US$500/kWh just a few years ago. OEMs are also looking for a return on their high R&D spending as part of their electric machine development.

As a result, machines come at a high premium, ranging anywhere from 40-100% added on to the cost of a typical diesel machine, depending on size and machine type. Despite this, the savings generated through operation are great enough to make electric machines cheaper overall on a TCO basis. This applies broadly across all machine types that IDTechEx has analyzed, where the electric machine premium can be made up for within its typical lifetime.

Over the last 5 years, many machines have been built as retrofits of existing diesel machines. This incurs an additional high cost for retrofitting labor, which shifts the balance of TCO back in favor of diesel machines. IDTechEx estimates roughly US$60,000 retrofitting cost for a 20-tonne excavator and even more for larger machines. However, the retrofit business model is used far less frequently as OEMs move production in-house, and customers will be able to benefit from the improved TCO.

How will costs and TCO evolve?

As the shift from retrofit to in-house production continues, OEMs can consolidate their development efforts, which should help bring down costs. At the same time, growing demand for electric machines means OEMs will be able to achieve more significant economies of scale, both in the cost of batteries and other machine components. IDTechEx’s conversation suggests that, with the increased scale of production, OEMs could achieve battery pricing of US$200/kWh – still noticeably higher than what is seen in the automotive market but the lowest that construction machines have seen until now. Battery manufacturers are still working on bringing their own costs down too, which means the price decline of batteries for construction could continue even beyond this.

In the long run, price premiums of electric machines are expected to drop to only incorporate the cost of its battery pack. This will be achieved when the volumes of production are sufficiently high, and OEMs are no longer investing as much into R&D. The additional cost of an electric machine should only constitute the relevant electric components – and while motors and power electronics have some associated cost – these are far less expensive than the battery pack which will make up the bulk of the long-term premium.

A drop in upfront cost like this creates even more favorable TCO and should convince more customers to make the switch to electric. Many of these potential customers are still more concerned about upfront costs than the overall TCO, so this change may be the one that has the greatest impact on the success of electric construction machines.

The “Electric Vehicles in Construction 2024-2044: Technologies, Players, Forecasts” report from IDTechEx presents detailed TCO analysis for a wide range of construction machine types with in-depth scenario analysis.

Read also: [Interact Analysis] Challenging 2024 for US construction industry