[Interact Analysis] Jungheinrich is top of the pack for off-highway batteries in EMEA and Americas

The results are in from the latest battery pack market rankings, published in the Interact Analysis Off-Highway Powertrain report by Jamie Fox, Principal Analyst at Interact Analysis. Jungheinrich came out on top for battery packs in EMEA and Americas for loaders, telehandlers, excavators and tractors

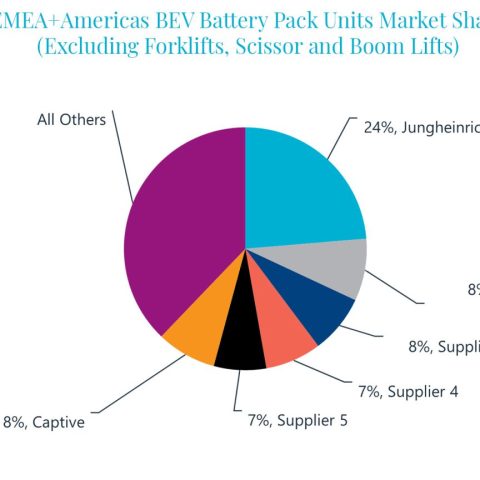

Jungheinrich came out on top for battery packs in EMEA and Americas for loaders, telehandlers, excavators and tractors, with the majority of sales into the construction equipment industry. This excludes the company’s thriving electric forklift business, which is not part of this ranking.

With several key clients in the construction industry, Jungheinrich takes the top spot primarily because a few key customers have higher shipments of battery electric vehicles (BEVs). It has been able to take its forklifts business model and apply its products and learnings to compact construction equipment. However, the company doesn’t have products for larger, high voltage off-highway equipment.

Diverse and changing landscape for EMEA and Americas off-highway batteries market

Many equipment vendors don’t use Jungheinrich at all. The market for battery packs is very diverse with many other suppliers competing. BorgWarner, Forsee Power, Turntide, Volvo and Wamtechnik are among the top 10 companies, but we identified over 20 companies in this space. This is a marked change from only two years ago, when many people were unable to name more than one or two battery companies that were really focused on the off-highway sector. The landscape is clearly changing as more organizations realize the market’s potential. Many players have a high share of their sales with 1-3 customers, meaning that changes in the rankings are likely in the future.

The eventual winners in the BEV battery packs market will need good guarantees, confidence in their brand and good technical execution. They also need to bring down prices using a scalable (possibly modular) approach, cost reductions in packaging and negotiating good cell prices. However, it’s not necessary to match the prices seen in cars, as higher prices can be justified in off-highway given the volumes, the requirements for some customization and the need for products to operate in rugged environments. The average price is still clearly above $300/kWh in 2024 (much higher where volumes are very low) and we predict it will still be above $200/kWh in 2030.

Read also: [Interact Analysis] Forecasts for the global forklift market

Prices need to fall for future success of off-highway electrification

Battery pack pricing is a critical reason why electric machines are often double the price of conventional machines, leading to a long payback period that makes it difficult to forecast high sales at present. Over time, battery electric vehicles need to get to 1.5x conventional machines in upfront cost, rather than the current 2x. This can be achieved by economies of scale, less expensive cells, and packaging efficiency savings. Efficiency savings in transmission, motors, and other components can also help reduce the size of the battery pack needed, and any reduction of the weight of the machine is also a bonus (if it doesn’t have a negative impact on performance).

Next generation designs can help to drive down the cost of electric machines. This is where machines are specifically designed as electric, with little or no hydraulics, packaging of components and cooling, with space for the battery and other components considered from the outset. Such machines may look different from conventional models to improve efficiency and performance.

Given that lower cost, next generation machines with inexpensive battery packs are not yet available, the market is small for now, with only an estimated 4,207 battery packs for electrified off-highway vehicles (excluding forklift, scissors and boom) sold in EMEA and Americas during 2023. However, we forecast market growth to 142,709 in 2030, which explains why so many companies are entering this space now. Total revenue for battery packs (in EMEA and Americas, and excluding forklift, scissors and boom) was $54 million in 2023 and is forecast to reach $1.3 billion in 2030. Battery pack sizes can be as low as 25 kWh (a typical mini excavator) or reach hundreds of kWh for medium and large excavators and mining machinery.

We have tracked very modest growth in 2024 due to a weaker construction industry, and higher interest rates. However we think growth will improve later on. This prediction does assume that existing government incentives are enacted and not cancelled, and that additional incentives are introduced over time.

This particular insight focuses on EMEA and Americas, but we have also observed interesting activity in Asia, especially China.