[Interact Analysis] Slowdown in 2024 forecast for European construction equipment market

2024 is likely to be a tough year for the European construction equipment market. Civil engineering projects are being slowed whilst housebuilding is also experiencing a downturn due to high interest rates, inflationary pressures, and poor GDP growth. According to market intelligence specialist Interact Analysis, manufacturers and dealers should concentrate on service and maintenance sales to help weather the storm in 2024. Read the latest insight by Alastair Hayfield, Senior Research Director at Interact Analysis.

There is no escaping the fact that the European construction market is in for a hard 2024. Anemic GDP growth, high interest rates and persistent high inflation mean that housebuilding is slowing down across the continent, and some civil engineering projects are being slowed or delayed as costs spiral. Furthermore, industry investment in new factories and facilities will likely slow too as economic output remains sluggish across much of Europe.

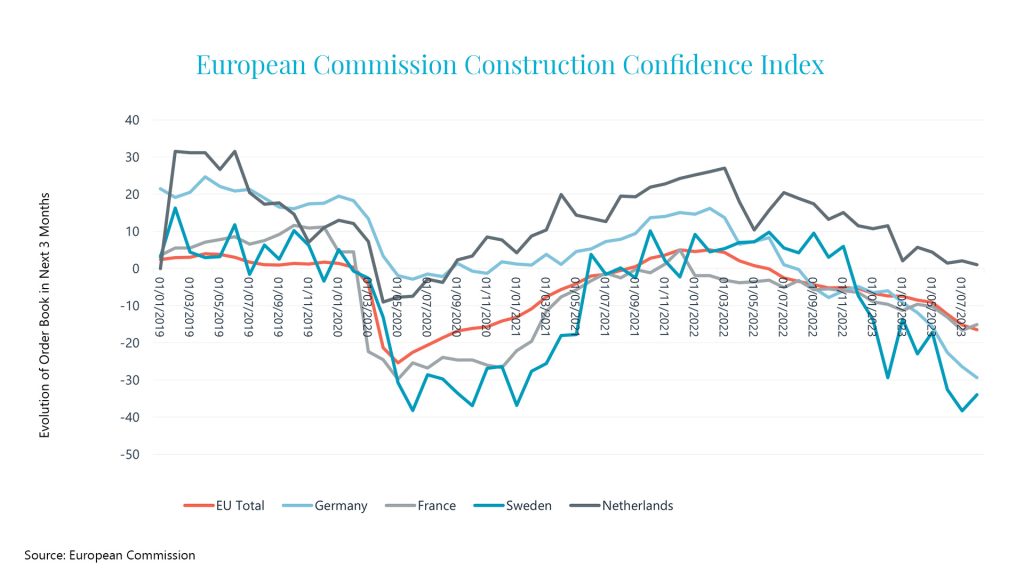

Data from the European Commission’s Confidence Index for Construction paints a bleak picture.

Since the Ukraine conflict began, confidence in future orders has ebbed away across Europe. High interest rates are curbing consumer demand for housing and businesses are putting investment decisions on hold, as 2024 shapes up to be a weak year for growth. Although construction equipment companies have been able to fulfil backorders and build up inventories at dealers, that opportunity is passing quickly and it is now increasingly clear demand for new equipment will cool across Europe in 2024.

UK: housing market to struggle, infrastructure to slow

By almost any measure you could choose, both confidence and orders in the UK construction market are evaporating.

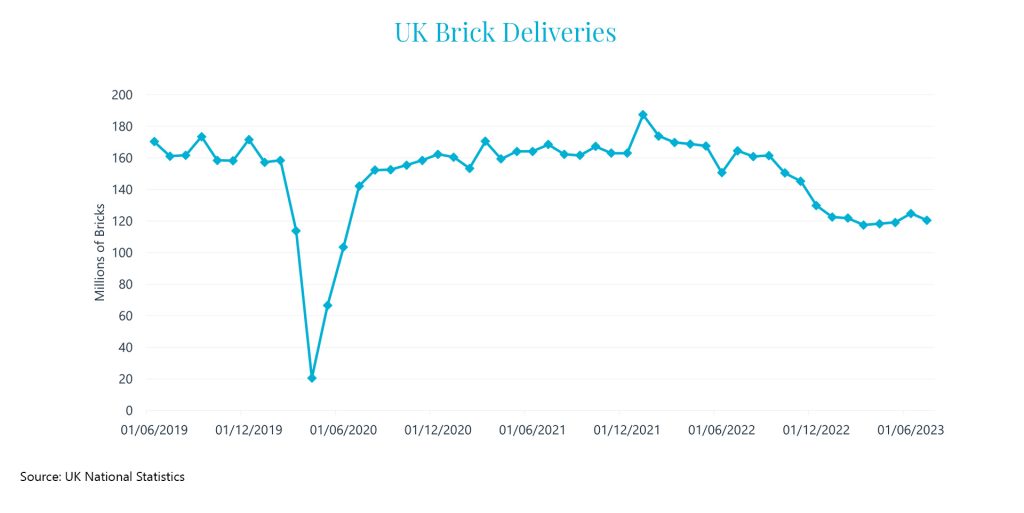

New private housing, new infrastructure and new private industrial orders have all declined in recent months, falling from a high experienced after the Covid-19 pandemic. Furthermore, deliveries of bricks in the UK – a leading indicator for performance in the housing sector – have slumped to below pre-pandemic levels.

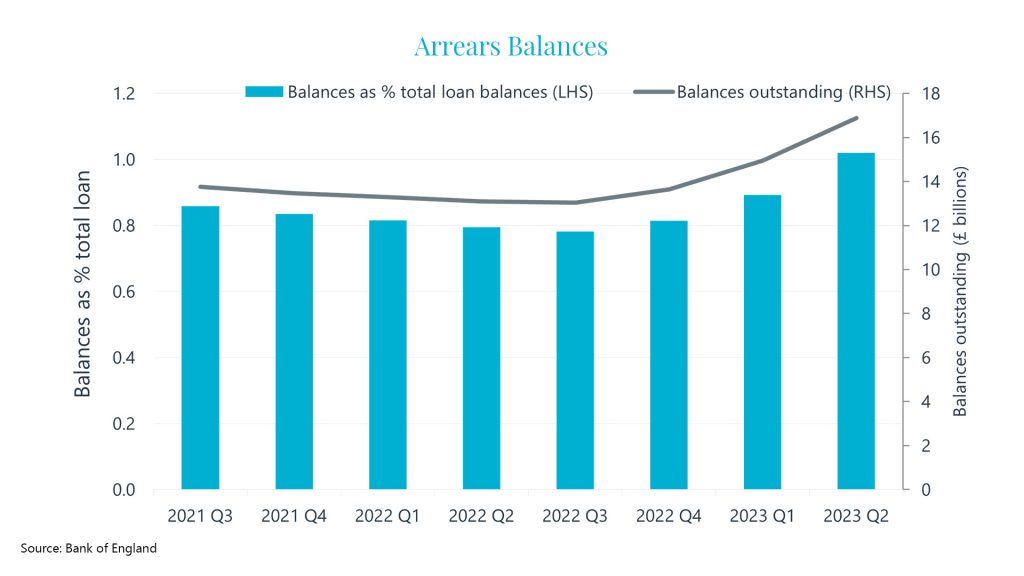

As with other countries in Europe, increases in the UK’s central bank interest rate intended to tackle rampant inflation have made mortgages less affordable and put growing pressure on household finances. This has had a chilling effect on the UK housing market, with many housebuilders pausing completions as demand for new-builds dries up. To indicate the scale of the problem, mortgage arrears have moved from a fairly stable 0.9% of total loan balances to 1.1% in the first half of 2023, with the trajectory worsening.

While infrastructure projects such as HS2 have allowed the UK to maintain growth for infrastructure projects in recent years, there is evidence that spiraling materials costs are pushing the UK government to scale back and delay certain roadbuilding and infrastructure projects. This will have a negative impact on the construction equipment market, particularly the heavy-duty earthmoving sector.

France: fairing better but not by much

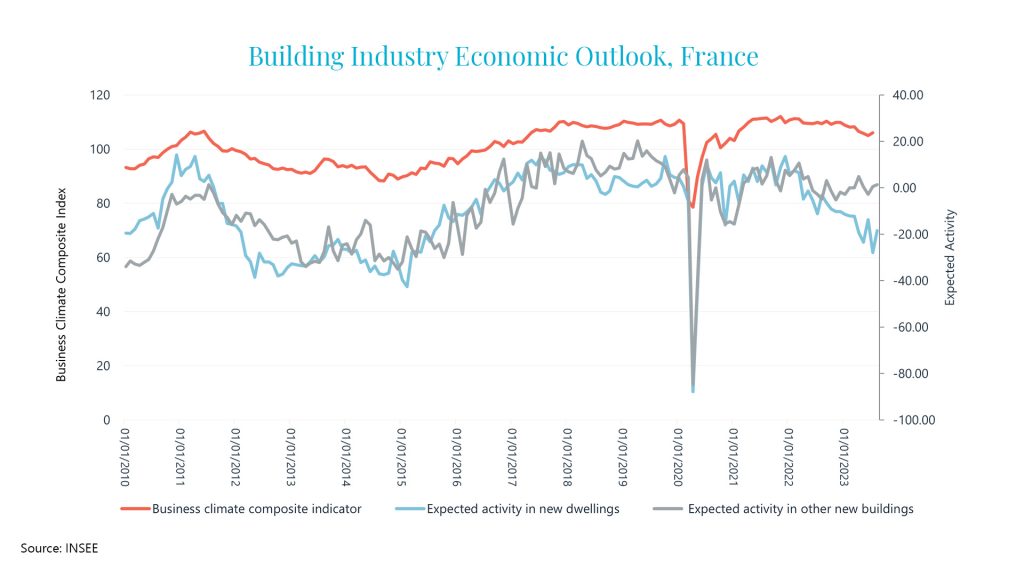

As with other European countries, rising interest rates are starting to put a dampener on the housing market in France. However, as can be seen from the overall construction climate index and the expected activity for non-residential buildings, the outlook is brighter with a more gradual decline and some indication that the outlook is stabilizing. There is strong construction activity around the Paris Olympics in 2024 and the Grand Paris Express metro expansion.

Strong headwinds in Germany

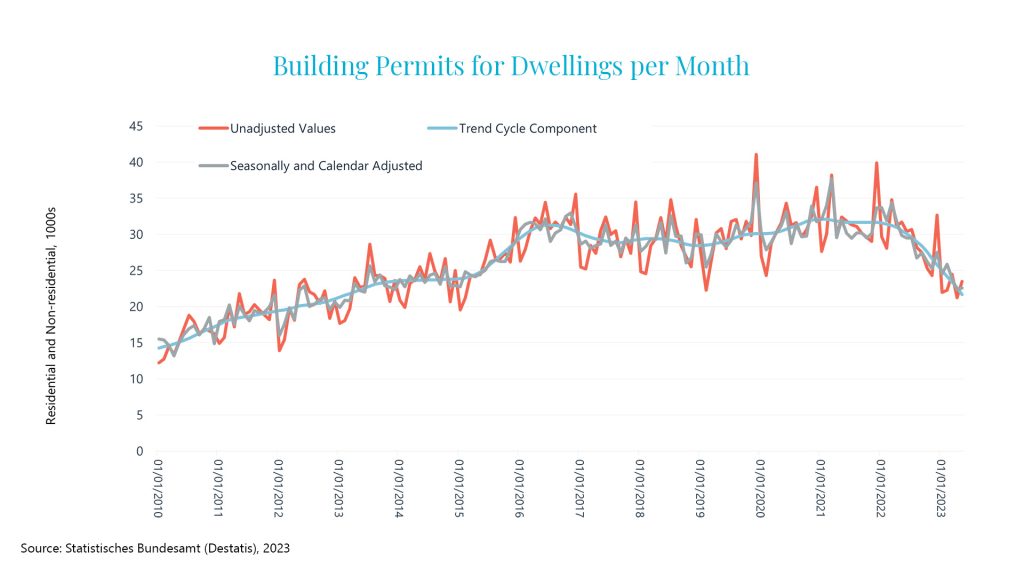

As with other European countries, Germany is grappling with high inflation and increasing interest rates. In the past two years, order books have remained strong for builders, particularly for housing. However, as can be seen from new building permit data, demand has started to slide and it is clear that the residential sector will slow in 2024 as work on current projects ends and is not replaced with new volume.

Germany’s traditionally strong manufacturing economy is likely to struggle in 2024 as new orders decline through the end of 2023. Many manufacturers are already warning about lower growth through 2024 and this will be reflected in a reduction in spending on new facilities.

Focus on product efficiency

Selling machinery in a down market is always a challenge. However, one of the major challenges for machinery fleets at the moment is dealing with inflationary cost pressures. A focus on selling machinery and products that help cut fuel costs or speed up project tasks will be warmly received and may be a key differentiator at the point of sale. Machine builders and component suppliers should not hesitate to invest in marketing and activities centered around products that can demonstrate a clear reduction in OPEX.

Service may support revenue

Another way in which manufacturers and dealers may weather the worst of 2024 is to concentrate on service and maintenance sales. Machinery always needs servicing and, if end users are not upgrading their equipment, now is the perfect time to stress the importance of servicing and maintaining equipment (particularly older equipment) in order to reduce downtime and maximize the performance of existing assets.