[Interact Analysis] When will lithium-ion battery forklifts overtake sales of other forklifts?

According to the latest insight by Maya Xiao, Research Manager at Interact Analysis, the demand for lithium-ion forklifts has increased rapidly in recent years. The proportion of forklifts powered by lithium-ion batteries will surpass the number of lead-acid battery powered forklifts in China and some European countries by 2025.

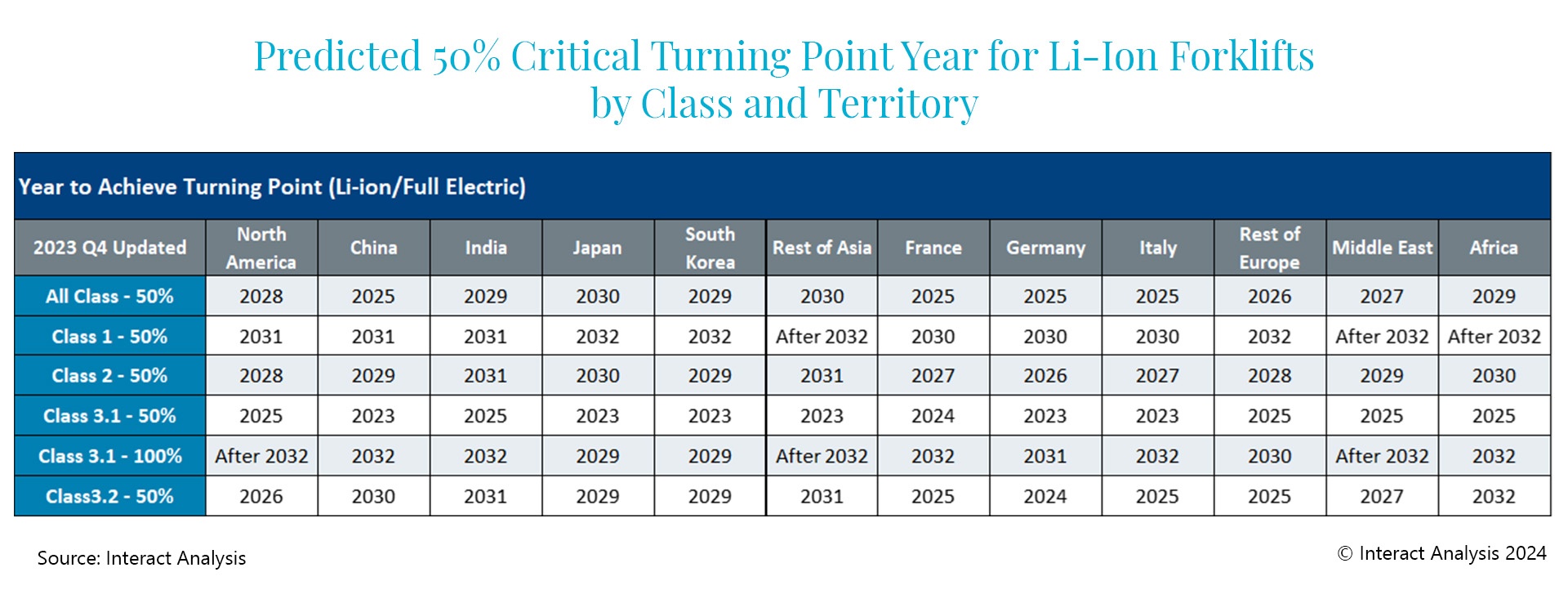

In recent years, demand for lithium-ion forklifts has been increasing rapidly. According to the latest prediction from Interact Analysis, forklifts powered by lithium-ion batteries will surpass the proportion of those powered by lead-acid batteries in electric forklifts by 2025 in China and some European countries. It is expected that by 2030, the global market share of lithium-ion models will exceed 50% in all classes, and Class 3.1 will become the first forklift type to achieve over 50% lithium-ion rate (the forklift database and lithium battery penetration rate prediction model of Interact Analysis cover Class 1-5 forklifts, consistent with the definition of WITS (World Industrial Trucks Statistics). By 2032, many regions, including China, will achieve full lithium-ion rate of Class 3.1.

What is a ‘50% critical turning point year’, according to Interact Analysis?

Interact Analysis uses the indicator of ‘50% critical turning point year’ as an important evaluation criterion. In this case, the term refers to the year in which lithium-ion models account for more than 50% of the sales of forklift models in the region for the first time.

For example, the chart below demonstrates that we predict Germany will see the proportion of lithium-ion battery Class 1 forklifts exceed 50% of Class 1 sales in 2030. This means that the shipment volume of lithium-ion models will exceed that of lead-acid models in this year.

50% critical turning point year for key countries

According to our forecasts, China and a number of European countries (France, Germany, Italy, Spain, the UK, and Sweden) will have the earliest 50% critical turning point year: that is, the proportion of lithium-ion/electric vehicle models (Class 1-3) will reach 50% as early as 2025.

The Chinese market is predominantly driven by the rapid lithium-ion electrification of Class 3.1 forklifts. In 2022, the global shipment volume of Class 3.1 reached 355,318 units, of which 192,731 units were shipped in the Chinese market (over 60% of the total). The total volume of forklifts shipments in the Chinese market over the same year was 686,000 units, with Class 3.1 models accounting for 28.1%.

The penetration rate of lithium-ion batteries in major European countries largely benefits from early electrification. In 2022, electric forklifts (including lead-acid, lithium-ion and fuel cell batteries) accounted for 67.8% of the global forklift market, 59.5% of the market in China, and about 90% across the European region. Compared with the dual line integration of gasoline to electric vehicles and lithium batteries replacing lead acid in other parts of the world, the European region has a greater focus on lithium-ion batteries replacing lead acid.

The volume of lithium-ion forklifts in Africa is expected to reach 50% by 2029, primarily due to the dependence of the region’s market on imported forklifts from China. The penetration rate for lithium-ion batteries in forklifts in Africa is directly related to the product strategy of Chinese manufacturers.

50% critical turning point year for major vehicle models

According to the insight by Interact Analysis, by 2030, the lithium-ion penetration rate of Class 1 forklifts in most countries will exceed 50%, with the exception of Japan and South Korea, where local manufacturers dominate the market and have responded more slowly with lithium-ion electric vehicle models.

In terms of Class 2 forklifts, North America and Japan are the two largest markets. This is closely related to the level of automation in local warehouses and the type of shelving.

Class 3.1 forklifts will be the earliest model to reach the 50% critical turning point, and by 2025, all regions will achieve a 50% lithium penetration rate. Class 3.1 is also the only vehicle model to achieve full lithium electrification within the forecast period (before 2032).