IEEFA report: pros and cons of carbon capture

Adding carbon capture and storage to fossil-fired power plants will have unsustainable implications on electricity prices, with the public, businesses and governments likely to suffer the immense cost, a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) reveals.

Adding carbon capture and storage (CCS) to fossil-fired power plants will have unsustainable implications on electricity prices, with the public, businesses and governments likely to suffer the immense cost, a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) reveals.

“The economic case for CCS in the power sector is weak, considering input cost and funding uncertainties, continued failures of the technology, and the constantly improving alternatives,” says report co-author Christina Ng, IEEFA’s Research and Stakeholder Engagement Leader, Debt Markets. “Yet, policymakers are recognizing it as a sustainable investment or providing generous financial incentives too easily to CCS producers and developers.”

CCS in the power sector – which directly captures carbon dioxide (CO2) from a power plant, then compresses, transports and stores it – is one of the new use cases being discussed as net-zero energy solutions. However, it faces many challenges, including environmental concerns.

The Synthesis Report under the Sixth Assessment Report published by the International Panel on Climate Change on March 20 placed CCS as the least preferable mitigation option, by way of marginal abatement cost or potential contribution to net emission reduction by 2030 for the energy sector. Higher priority solutions include wind and solar energy.

IEEFA previously reported that carbon capture technologies were not yet ready to warrant them investable. Its latest report focuses on CCS in the power sector and dives into the economics, including its impact on the cost of power.

Uncertain cost trajectory and optimism bias

The report finds that with limited practical experience, the actual costs of deploying CCS and its cost trajectory remain unclear. At present, no known new power plants have been built with CCS installed and operating at commercial scale. While two major retrofit power projects, the Boundary Dam in Canada and Petra Nova in the United States, have been implemented, Petra Nova has since suspended operation, and both projects had performed well below target capture rates of 90%.

According to the report, applying carbon capture technology to coal and gas power generation, even before considering the required transport and storage of CO2, will significantly increase the facility capital expenditure and operating and fuel costs, affecting the case for investment.

“The cost of CCS as a decarbonization option is more than just the cost of the carbon capture technology. The transport, storage, monitoring and verification, plus any additional compliance and liability costs will need to be taken into account for CCS to be considered a climate solution,” says report co-author Michael Salt, a guest contributor with IEEFA and an energy economics and finance analyst.

Optimism bias is also rampant. Proponents of CCS provide low-cost forecasts that are a long way from the estimates of prominent organizations and significantly more hopeful than the likely reality. Additionally, estimates generally do not include a range of other costs including transport, storage, monitoring and possible remediation or penalties, which have a high degree of variability, and so they only paint part of the picture of carbon capture expenses.

While the real cost of applying CCS in the power sector is uncertain, the report considers how it could be recovered through these likely scenarios: embedding the cost in increased wholesale electricity prices, which would be passed through to retailers and then consumers; or having the government subsidize or find alternative sources of funding to bear the cost of CCS.

Impact on the price of electricity: Australia case study

Annual volume weighted average wholesale prices average between A$75 to A$95 per megawatt-hour (MWh) for Australia’s National Electricity Market (NEM) regions over the past decade, where thermal resources provide around 70% of power generation. If funded through electricity prices, applying CCS could be expected to increase these prices by A$100 to A$130 per MWh, or 95% to 175%.

This additional wholesale cost would then be passed on to energy consumers, who are unlikely to take well to increasing electricity prices to fund CCS in the power sector. Retail electricity prices have already significantly climbed due to recent global energy inflation, and are expected to rise further due to ongoing supply chain and geopolitical issues.

“Consumers, businesses, industry and retailers alike would logically seek out the most affordable electricity options that meet their needs, a more immediate priority for many than environmental and social factors,” says Salt.

If not directly passed on to energy consumers, any significant government spending or subsidization of CCS would ultimately be borne by the public through, for example, income taxes. The public may be unwilling to accept subsidizing unproven CCS technologies and, in turn, express their views through public elections.

IEEFA: carbon capture vs more affordable renewable energy plus storage options

The report finds that government subsidies contradict the need to use public funds responsibly in light of more technically sound options and the economical, rapidly improving and deflationary nature of renewable and battery storage alternatives.

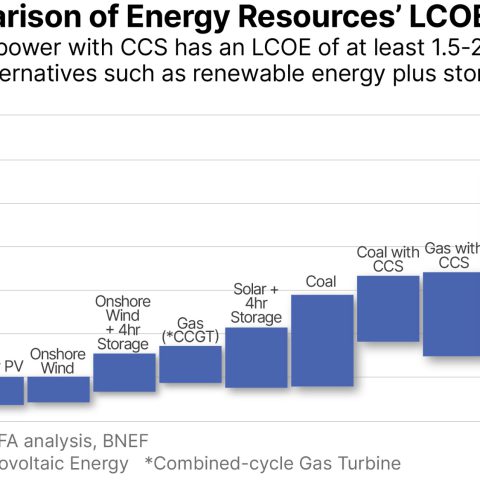

It also shows that the levelized costs of electricity (LCOEs) for thermal power generation with CCS are at least 1.5-2 times above current alternatives, which include renewable energy plus storage. It is therefore difficult to contemplate electricity users willing to support the use of CCS on power generation when affordable decarbonized options exist.

In addition, although solar and wind LCOEs have recently crept up, they are expected to return to a downward trajectory. Battery storage system prices and the resultant LCOEs will also likely improve dramatically as technology is deployed more widely at a much larger scale and displaces gas-fired firming in the longer term.

“Until a viable source of funding is available, who ends up paying for the cost of CCS in power generation is yet another uncertainty,” says Ng.

TO READ THE FULL REPORT CLICK HERE