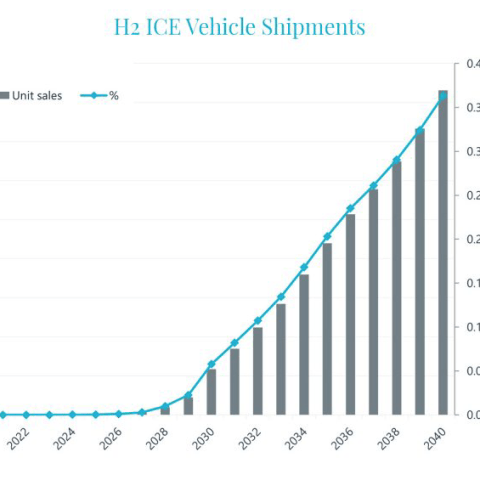

[Interact Analysis] 200,000 hydrogen engine vehicles to be sold in 2035

According to newly published research by Jamie Fox, Principal Analyst at Interact Analysis (and one of the speakers in our webinar on biomethane and hydrogen), hydrogen internal combustion engines (H2 ICE) are forecast to be sold in 220,000 vehicles in 2035.

According to newly published research by Jamie Fox, Principal Analyst at Interact Analysis (and one of the speakers in our webinar on biomethane and hydrogen), hydrogen internal combustion engines (H2 ICE) are forecast to be sold in 220,000 vehicles in 2035. The market is currently in development and most shipments will be after 2030 in areas such as trucks and off-road machines such as excavators, loaders and agricultural machinery.

However, challenging conditions in most applications mean that the shipments will only be a small minority of vehicles sold. H2 ICE is forecast to never reach the level of diesel or battery electric vehicles, as it instead looks to establish niches.

H2 ICE vehicles do have some notable advantages. The engine technology is reasonably similar to diesel engines, enabling use of existing knowledge, design and production vehicles. The vehicles can deliver high power, work with impure fuel, work in dirty and dusty conditions and refuel quickly.

On the other hand, there is no hydrogen infrastructure in place in almost all locations in the world, there is a lack of awareness about the technology and limited development so far. Most importantly, the current cost of hydrogen fuel is high – it will need a big reduction before the vehicles can become competitive. Even at half the cost of today, H2 ICE vehicles do not have a good total cost of ownership. The cost of the engine is not substantial, but the cost of the tanks adds a lot to the cost of the vehicle, then there is infrastructure and above all the hydrogen fuel.

In almost all cases, either diesel or BEV will be less expensive than H2 ICE (often both). So where does that leave the hydrogen engine? Firstly, early sales of a new technology are not necessarily made on rigorous practical grounds, and a minority of potential customers are willing to disregard total cost of ownership (TCO) in order to be the first to showcase a new technology.

Secondly, H2 ICE will target companies that are looking to move away from diesel for environmental/ legislative reasons but work in areas where BEVs cannot easily do the job. In large, off-road vehicles redesigning a machine for BEV just to sell 10 or 100 units will be slow to happen given that vendors of batteries and BEV vehicles are already struggling to keep up with existing demand. H2 ICE offers a simpler way to redesign many different types of off-highway vehicles. Battery weight is also sometimes cited as an issue for larger vehicles. Perhaps more importantly, some off-highway vehicles are in operation 10 or 15 hours a day. This is fundamentally difficult for BEV vehicles as the battery would run out.

Interact Analysis still forecasts more shipments for H2 in trucks, however. This is simply because the total available market for trucks is so large, and even a small share amounts to a significant share of vehicles. In September 2022. a project was announced in relation to hydrogen ICE trucks. The project is called HyCET (Hydrogen Combustion Engine Trucks) and is led by the BMW Group, along with Deutz, Volvo Trucks, DHL Freight, TotalEnergies, and Keyou GmbH. It is planned to develop an 18-ton truck with a Deutz engine. The project will use funding from the German Federal Ministry for Digital and Transport (BMDV).

However, while H2 ICE vehicles can – at least in theory – be zero carbon eventually – NOx emissions will still remain. While the NOx emissions are expected to be lower than diesel, and many are working on this, they cannot be reduced all the way to zero. While some may say that this is a reasonable trade off, questions remain about whether that will be enough for legislators in places such as California and the EU.

To read the full research by Interact Analysis, click here.