[Interact Analysis] Where are the world’s 1,100 hydrogen refueling stations located?

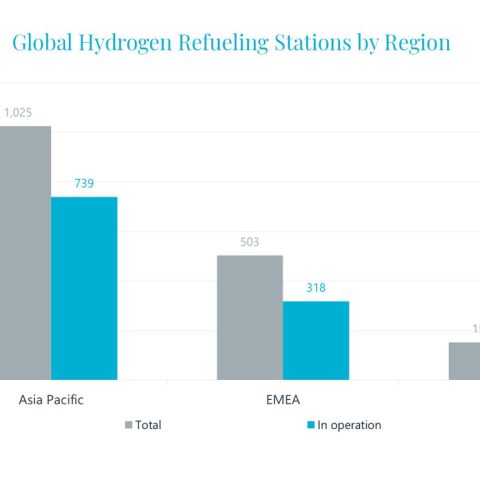

The number of hydrogen refueling stations is increasing. According to this latest insight by Shirly Zhu, Principal Analyst at Interact Analysis, global HRS deployments reached 1,680 units during the first half of 2024, with 1,148 in operation.

There has been mounting pressure to decarbonize fuel sources and turn to greener, renewable solutions. Hydrogen shares the same benefits as diesel, such as range and short fueling times, while also promising reduced carbon emissions, greater density and cheaper maintenance. Consequently, the construction of refueling infrastructure has become increasingly urgent due to the promotion of hydrogen in transportation applications in recent years.

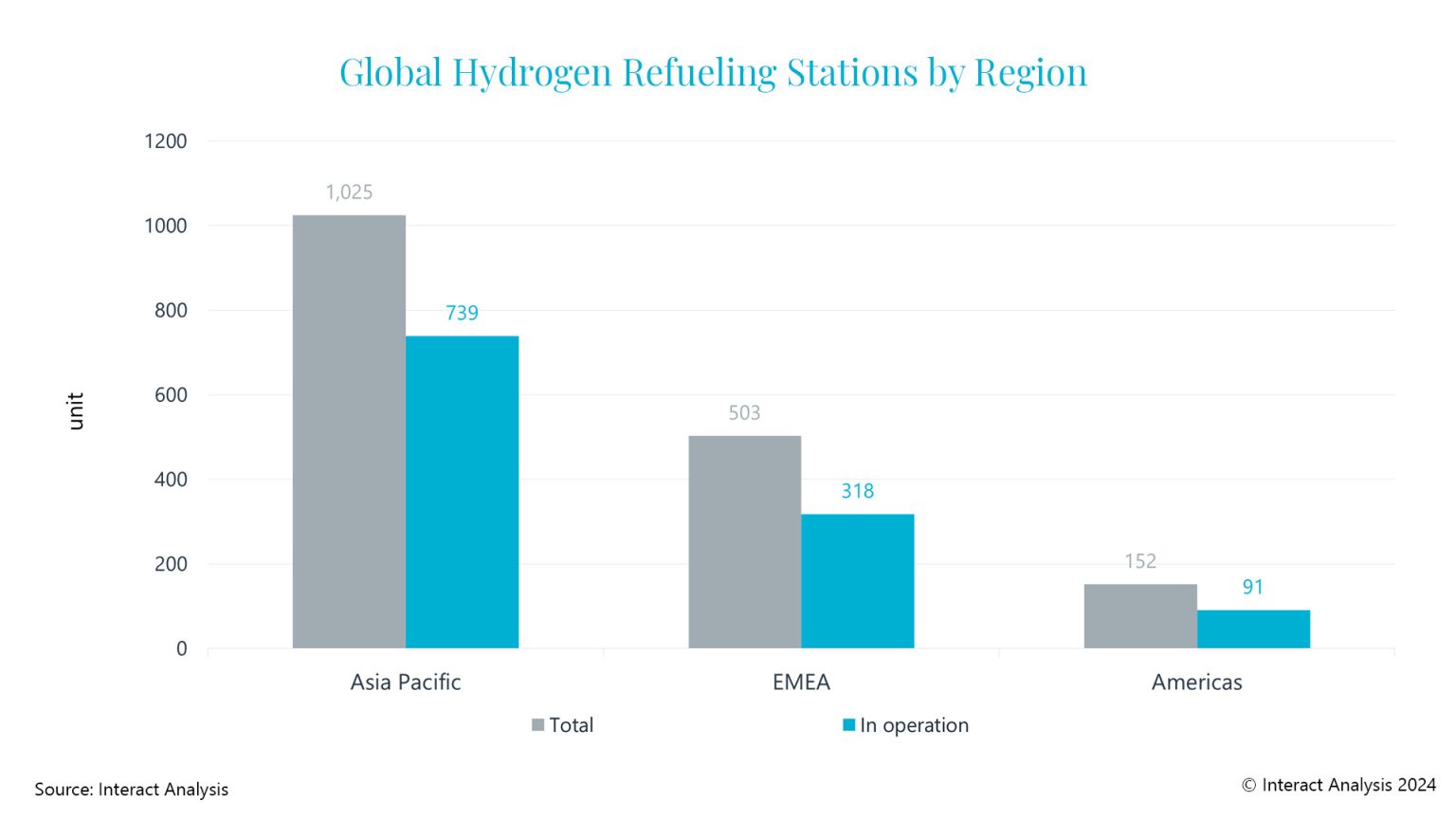

Interact Analysis has kept track of the global deployment of hydrogen refueling stations (HRSs). According to statistics, global HRS deployments, under construction and planning, reached 1,680 units during the first half of 2024 (“planning” stations refers to those that are announced with locations or investors). Among the 1,680 units – there are 1,148 hydrogen fueling stations that have commenced operation.

A growing number of countries started HRS construction, with Asia Pacific in the lead

During the first half of 2024, 41 countries and regions around the world had operating HRSs while another 7 countries were planning or constructing their very first hydrogen refueling station. However, the global distribution of hydrogen stations remains highly concentrated. Only 10 countries had 10 or more HRSs, accounting for 92% of the global total. China, South Korea, Japan and Germany have more than 100 operating stations, together accounting for 72% of the global total.

China, Korea and Japan led the expansion of the hydrogen refueling network

The Asia Pacific region had the largest number of hydrogen refueling stations in operation, accounting for 64% of the global total – 97% of which were located in China, South Korea and Japan. It’s worth mentioning that the gap between HRS numbers in South Korea and Japan is widening, despite originally being neck-and-neck in HRS deployments. South Korea opened 14 HRSs (particularly servicing fuel cell buses) in the first half of 2024, while Japan saw the closure of more than 10 HRSs from 2023 to present (mainly mobile stations). In addition, Australia and New Zealand have already commissioned 11 hydrogen refueling stations.

A growing number of European countries started hydrogen refueling station deployments. More than 20 European countries have deployed hydrogen refueling stations. Germany has the most extensive HRS network, accounting for 35% of the total HRSs in EMEA, followed by France. Israel, the United Arab Emirates and Saudi Arabia also have hydrogen refueling stations in operation. EMEA held a 28% share of HRSs in operation globally, while its share rose to 35% for global HRSs under construction and planning. This was, in part, thanks to the rollout of the EU’s TEN-T Regulation (Trans-European Transport Network), which incentivized the deployment of hydrogen refueling stations in European countries.

The United States’ 79 hydrogen stations are highly concentrated, especially in California – where more than 75% are located. Notably, the launch of the National Zero-Emission Freight Corridor Strategy in the US has caused states such as Texas to begin planning for HRS construction – especially refueling facilities for medium and heavy-duty vehicles. In addition, Canada kept deploying hydrogen refueling stations to support the promotion of hydrogen energy applications, amounting to a total of 9 hydrogen refueling stations in operation.

A snapshot of ‘milestone’ hydrogen refueling stations

Some ‘milestone’ stations listed below indicate hydrogen refueling stations become more diversified in terms of servicing applications and types.

The Incheon Gajwa LH2 HRS was inaugurated in April this year. It opened a new chapter in the deployment of liquid hydrogen refueling stations in South Korea, with the country announcing a plan to build 280 LH2 stations by 2030.

The Air Liquide’s Palace de l’Alma HRS was also inaugurated in April this year – this is one of a number of hydrogen refueling facilities built for the Paris Olympics. This event has accelerated France’s deployment of HRSs, totaling 79 stations in operation, second only to Germany within Europe.

The Port of Oakland HRS commenced operations in May this year. It is the first heavy-duty commercial vehicle HRS built by FirstElement Fuels, boasting the largest refueling capacity in the US to date. Deployments of HRSs for medium- and heavy-duty vehicles are likely to accelerate in California as the state has started to ban heavy-duty diesel vehicles.

The National Energy Group Battuta HRS became China’s first heavy-duty railroad hydrogen refueling station during June 2024, when it was officially put into commercial operation. Diversified hydrogen application scenarios trigger the need for HRSs for different applications.

Intriguingly, several countries have deployed their first HRSs during the first half of this year. Bulgaria’s first refueling station (Iskar HRS) as well as Singapore’s (Pasir Panjang Port HRS) commenced operation.

Read also: [Interact Analysis] Only 30% of China’s planned hydrogen refueling stations have been built